Nonresidential Continues to Struggle

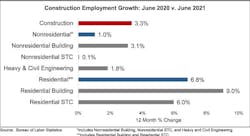

Residential and nonresidential construction sectors have differed sharply in their recovery since the pre-pandemic peak in February 2020, according to separate analyses of government data by industry associations.

Residential construction firms—contractors working on new housing, additions, and remodeling—gained 15,200 employees during June and have added 51,000 workers or 1.7 percent over the past 16 months, according to the Associated General Contractors of America. The nonresidential sector—comprising nonresidential building, specialty trades, and heavy and civil engineering contractors—shed 22,600 jobs in June and employed 289,000 fewer workers or 6.2 percent less than in February 2020.

According to an Associated Builders and Contractors analysis of the data, the construction industry has recovered 875,000, or 78.6 percent, of the jobs lost during the earlier stages of the pandemic.

Nonresidential construction’s employment decline in June fell mostly among nonresidential specialty trade contractors, according to ABC, with a loss of 14,800 net jobs. Heavy and civil engineering employment fell by 10,900 jobs, while the nonresidential building sector added 3,100 jobs on net.

“Yesterday, we learned that nonresidential construction spending declined across a broad spectrum of private and public segments in May,” said ABC chief economist Anirban Basu in a prepared statement. “Today, we learned that the industry lost jobs in June. None of this is consistent with optimistic projections for industry activity generated by ABC’s Construction Confidence Indicator. Perhaps a turnaround is right around the corner, but it has failed to emerge thus far.

“While many will extol the virtues of the headline jobs number and place substantial focus upon that, as a practical matter, today’s employment report is an utter mess,” said Basu. “That’s really the headline—that the numbers delivered by the government today are, when viewed collectively, nonsensical or at least very difficult to reconcile. According to the government survey of employers, America’s economy added 850,000 jobs last month. That was meaningfully above consensus expectations after two months of disappointing numbers. But a survey of households for precisely the same period indicates that the nation lost 18,000 jobs. The household survey also indicates that the labor force participation rate failed to rise, that the number of unemployed people in America rose by 168,000, and that the official rate of unemployment increased from 5.8 percent in May to 5.9 percent in June.

“In other words, today’s data regarding the U.S. labor market supply more questions than answers,” said Basu. “Most economists pay more attention to the establishment survey, which means that most assessments regarding today’s jobs report will be upbeat. Nonetheless, contractors and other economic stakeholders should be concerned by ongoing labor market dysfunctions, including an inordinate level of difficulty finding workers, elevated numbers of people quitting their jobs, and rising wages.

“While wage growth moderated in June, that may be because disproportionate numbers of entry-level workers re-engaged the economy given the lapse of enhanced unemployment benefits in certain states and their imminent cessation elsewhere. The entry of these workers in large numbers would tend to suppress average wage measures. Most contractors are likely continuing to experience substantial upward wage pressure.”

Total construction employment declined by 7,000 between May and June as the industry still employs 238,000 fewer people than before the pandemic. AGC officials said that job losses in the nonresidential construction sector offset modest monthly gains in residential construction as many firms struggle with worker shortages, supply chain disruptions and rising materials prices.

“It is hard for the industry to expand when it can’t find qualified workers, key building materials are scarce, and the prices for them keep climbing,” said Stephen E. Sandherr, AGC’s CEO, in a prepared statement. “June’s job declines seem less about a lack of demand for projects and a lot more about a lack of supplies to use and workers to employ.”