Lodging, Hospitals Fuel Nonres Growth

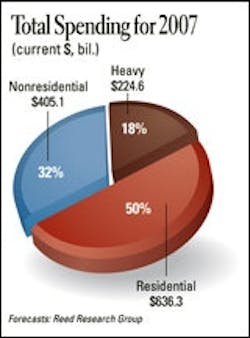

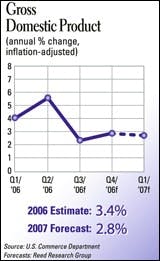

Nonresidential construction's expansion will offset the gradual downturn on the residential side, allowing overall spending in 2007 to match the growth registered in 2006. Total spending will grow 5.2 percent this year, after growing 5.3 percent in 2006.

Nonresidential construction spending will expand 12 percent this year and will continue expanding into 2008. Yet the 0.4-percent decline forecast in residential spending limits total construction spending to $1.27 trillion.

This growth number is only useful for gauging the demand/supply balance for labor and materials used in all construction markets, such as credit, equipment rental or ready-mix. The price and availability of resources specific to the housing market (lumber, plywood, gypsum, framing crews and plumbing fixtures) adjusted to the smaller, no-growth, market last spring. Pricing weakened with some significant declines, hiring turned to layoffs, wage rate growth stalled, and contractors' margins shrank. These market conditions will generally prevail through 2007 with the weakest period likely early in the year.

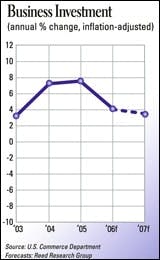

Business conditions are markedly different in the nonresidential-building and heavy-construction markets, which will again expand at a double-digit pace in 2007. Everything is reversed. Pricing is firming for materials specific to these markets, such as asphalt, aggregates and structural steel. Labor availability is worsening, and wage gains are accelerating. Contractor margins are improving as are those of their suppliers. These business conditions will prevail well into 2008.

The housing market hit the sustainable maximum size of around 1.95 million late in 2004. The subsequent growth to 2.27 million in January 2006 was caused by excess demand from speculative buyers and by households that were enticed out of apartments and manufactured housing by temporarily discounted monthly house payments. The market collapsed below the sustainable level when these sources of demand disappeared. Housing starts will stay below the sustainable level until the surplus inventory is absorbed. There is no fundamental problem with housing demand; homebuilders and mortgage brokers simply borrowed some demand from 2007–08 and advanced it to 2004–05.

The ongoing multiyear boom in nonresidential construction is largely the usual strong market at the tail end of an economic expansion. The current expansion has the potential to persist well beyond 2008 if it matches the strength of commercial, institutional and civil building booms in previous building cycles.

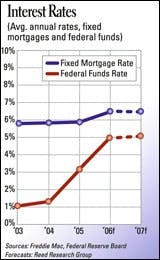

The key drivers for the nonresidential boom are cheap credit; immigration, which doubles population growth; above-average consumer and business confidence, which gives the courage to turn cash into spending; the improvement of state and local government budget balances to above-average status; and rising space and facility capacity needs in a growing economy. These drivers should remain strong. Indeed, they have all strengthened in the past few months after a brief weakening at midyear when we were unsure how high gasoline prices would go.

The hotel market was the fastest-growing project type in 2006 with spending expanding 48.7 percent. Growth will be halved to 24.8 percent in 2007, but hotels remain the fastest-growing project type in 2007. Hotel revenues jumped 7 percent in the first nine months of 2006 compared to the same period in 2005. That boosts net income substantially in this highly leveraged business. The value of hotel starts, according to Reed Construction Data, increased 94 percent in the same period ensuring strong growth in spending beyond 2007.

Factory construction spending increased 22.9 percent in 2006, fueled by an earlier surge in starts. But factory starts have been halved in the first nine months of 2006, so jobsite spending will only rise 7.8 percent in 2007.

Highway construction spending jumped 16.8 percent in 2006, although as much as half of this gain was inflation. This followed a 73-percent rise in the value of highway starts in 2005 when the federal highway program was renewed and state tax revenue soared. Highway spending will increase only 5.8 percent in 2007 as the 2005 starts surge is built out.

Regionally, new project starts are expected to be strongest in the Northern Plains, Rocky Mountains and Gulf States. The weakest is in the Mid-Atlantic (outmigration), South Atlantic (hurricane-driven construction and property-tax increase), and especially, the Pacific (migration out of California to cheaper nearby areas) states. Nationally, the value of construction starts will grow more slowly in 2007, except in three regions. Starts will increase more quickly in the Mid-Atlantic where the dominant business and financial services industries always recover late in an economic expansion. Similarly, starts growth will be faster in the South Atlantic due to the delayed post-hurricane recovery. The small 2007 improvement in the Pacific region is largely due to more public spending in California.