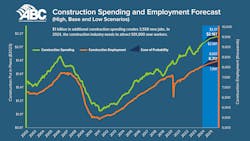

Some 501,000 additional workers will be needed to meet construction’s demand for labor, according to Associated Builders and Contractors. The number, based on modeling done by the group, excludes “the normal pace of hiring in 2024.”

“ABC estimates that the U.S. construction industry needs to attract about a half million new workers in 2024 to balance supply and demand,” said Michael Bellaman, ABC president and CEO, in a statement. “Not addressing the shortage through an all-of-the-above approach to workforce development will slow improvements to our shared built environment, worker productivity, living standards and the places where we heal, learn, play, work and gather.”

See also: Demand for Construction Jobs Remains High

ABC’s model uses the historical relationship between inflation-adjusted construction spending growth, sourced from the U.S. Census Bureau’s Value of Construction Put in Place Survey, and payroll construction employment, sourced from the U.S. Bureau of Labor Statistics, to convert anticipated increases in construction outlays into demand for construction labor at a rate of approximately 3,550 jobs per billion dollars of additional spending. This increased demand is added to the current level of above-average job openings. Projected industry retirements, shifts to other industries and other forms of anticipated separation are also embodied within the computations.

The construction industry unemployment rate averaged 4.6% for the second straight year, matching the second lowest level on record, while job openings remained historically elevated at an average of 377,000 per month through the first 11 months of 2023. As a result of labor shortages, contractors laid off workers at a slower rate than in any year between the start of the data series in 2000 and 2020.

“Broadly, there are two factors shaping the interaction between construction worker supply and demand,” said Anirban Basu, chief economist ABC, said in a statement. “There are structural factors, including outsized retirement levels, megaprojects in several private and public construction segments and cultural factors that encourage too few young people to enter the skilled construction trades. There are also structural factors, including those related to interest rates, consumer sentiment and general economic performance.

“Over the past two years, cyclical influences have helped diminish the gap between construction worker supply and demand,” said Basu. “Though nonresidential construction spending has continued to surge, homebuilding segments have felt the impact of higher borrowing costs more intensely. With interest rates set to decline in 2024 and 2025, the expectation is that construction worker shortfalls will remain elevated. Among other things, that would delay the rebuilding of American infrastructure and the creation of new domestic supply chains. It would also tend to drive up the cost of construction service delivery, impacting American enterprise and taxpayers alike.

“Meanwhile, structural influences persist,” said Basu. “More than 1 in 5 construction workers are 55 or older, meaning that retirement will continue to contract the industry’s workforce. These are the most experienced workers, and their departures are especially concerning.”

In 2025, the industry will need to bring in nearly 454,000 new workers on top of normal hiring to meet industry demand, and that’s presuming that construction spending growth slows significantly next year, the group said.

Source: Associated Builders and Contractors

About the Author

Harlee Hewitt

Harlee is a former associate editor for Construction Equipment.