Optimists Not Backing Down on Nonresidential Market

Early prognostications from the American Institute of Architects, Associated Builders and Contractors, ConstructConnect, Dodge Data & Analytics, and FMI indicate that 2018 may be a little less rosy for the nonresidential and multifamily construction markets.

Construction Sector Reports

Dodge suggests the U.S. construction industry has shifted into a “mature stage of expansion.” The 11 to 13 percent annual growth in construction starts we witnessed in 2012-15 will slow to 4 percent in 2017 and 3 percent in 2018. ConstructConnect is calling for 2-3 percent growth in nonresidential building starts between 2018 and 2021. FMI is a bit more bullish: 5 percent growth in nonresidential construction spending in 2018, then 4 to 5 percent in 2019-21.

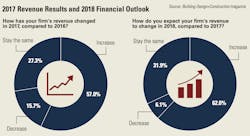

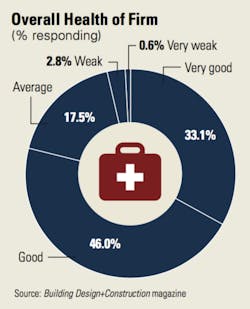

Despite the tepid outlook by construction economists—and numerous reports throughout 2017 that pointed to a looming growth slowdown for several major building sectors—optimism among AEC professionals has not waned. In fact, it has strengthened, according to architects, engineers, and contractors surveyed by Building Design+Construction.

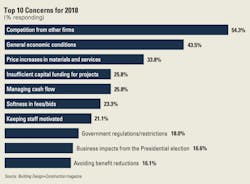

And while it has been an erratic and drama-filled first year for the Trump Administration—travel ban, Russian election interference probe, border wall financing fiasco, Paris Agreement withdrawal—the vast majority of AEC professionals are not overly concerned that the Trump-led White House will negatively impact their businesses. Just 16.6 percent of respondents cited “business impacts from the Presidential election” as a top-three concern heading into 2018. This sentiment is a somewhat dramatic turn from the post-election attitude, when nearly a third (31.7 percent) indicated that Trump was a major concern heading into 2017.

So, what are the top AEC business concerns for 2018? Competition from other firms (54.3 percent), general economic conditions (43.5 percent), price increases in materials and services (33.8 percent), and insufficient capital funding for projects (25.8 percent) top the list. Trump was at the bottom, along with avoiding benefit reductions, avoiding layoffs, and keeping staff motivated.

When asked about their top business development strategies for the next 12 to 24 months, respondents most often cited an increase in marketing/PR efforts (47.4 percent), selective hires to increase competitiveness

(46.3 percent), investment in technology (44.3 percent), staff training/education (43.5 percent), and launching a new service or business opportunity (38.0 percent). At the bottom: open

a new office, strategic acquisition,

and acquiring a new service or business opportunity.