Credit Causes Economy to Crawl

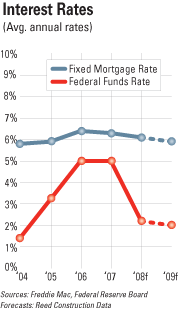

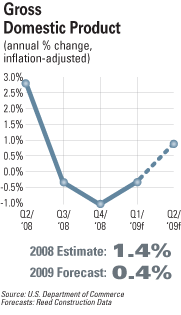

Construction will suffer along with the general economy through most of 2009 as the economic recession moves slowly through the year. Unlike other economic downturns, however, credit will be expensive, more difficult to obtain, and will put serious pressure on both private and public construction projects.

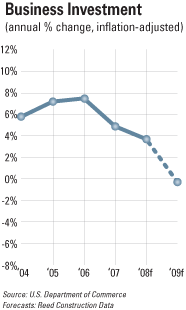

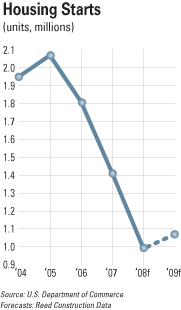

Construction spending will continue its three-year decline through the third quarter of 2009, down 9.5 percent in current dollars and more than 20 percent after adjustment for project-cost inflation. The precipitous spending declines in residential construction will finally reach bottom in 2009, albeit late in the year. Heavy construction and nonresidential construction spending, on the other hand, will drop sharply in 2009 after years of robust double-digit growth.

Construction equipment users and their suppliers will face subpar economic growth until late in 2010, which means better pricing and availability. Supply conditions loosened at the end of last summer when the world commodity price boom abruptly reversed. Materials, labor, equipment and design resources will be relatively more available and less expensive during the next two years.

Last fall’s credit freeze slowed some ongoing projects when the flow of short-term credit to project owners was interrupted. Other scheduled project starts were delayed due both to delays in financing and a worsened outlook for space and facility capacity needs. Projects in the pre-start development phase were slowed for similar reasons.

Some of the delayed projects will be back on track when the credit freeze thaws, which, at this writing, was expected to occur by mid-November 2008. Most, but not all, businesses in the construction and other nonbank industries should again be able to obtain the credit needed for normal business operations. Financially marginal firms will be rationed out of the credit market for several years. In addition, firms that were able to obtain credit at the end of 2008 will need less credit in a weaker economy than they anticipated needing early last summer. And the credit will be more expensive.

Banks will move to recover their losses from defaulted home mortgages as central banks and Treasuries around the globe lower credit costs in order to enable lenders to add liquidity and restore loan availability. Actual loan rates for customers, though, will be higher than normal as banks hoard scarce capital and ask for higher spreads, or premiums, over their own borrowing rates. So instead of the typically cheap credit during recessions and periods of subpar economic growth, credit will be expensive in 2009.

Changes in spending in any construction sector depend on how closely its financing is connected to world financial markets and how sensitive the demand for its space or facility capacity is to changes in spending in the economy. Housing is the sector most closely connected to financial markets. But with the housing market now restricted to households with solid credit records, new home mortgages are attractive to lenders. Housing will be little affected by the credit freeze.

The private commercial market, however, will be negatively affected by the credit freeze. Ongoing developments are frequently financed with short-term loans intended to be rolled over frequently. Some of these loans could not be refinanced in late 2008, and others could be rolled over only with a much higher credit cost. In addition, some projects approaching the financing phase in late 2008 were stalled when the expected credit arrangements could not be made. Public and institutional construction were less directly hit by the credit freeze. Projects funded from cash on hand or ongoing revenues were not impacted, but projects funded from bonding did suffer. Municipal bonds are typically higher quality investments for lenders than speculative commercial property.

The feedback on construction spending from the now weakened outlook for economic growth is initially largest for private commercial projects but, with a delay, will be as large for public and institutional projects. The impact on housing, usually large, will be smaller in this recession since there was no excess home construction underway when the recession began.

The demand for commercial rental property is sensitive to economic conditions. Already, vacancy rates are rising and rental rates are declining. The expected rate of return from building a new commercial building has fallen sharply in the past few months. In an increasing number of markets, it is now more profitable to buy an empty building than build a new one.

Public and institutional construction will hold up much better during the early phase of the recession because there is no profit calculation in the calculus to make the build/not build decision. And there is no need to search for tenants. Eventually, falling tax receipts and investment earnings will force desired projects to be postponed. Already, there are widespread reports of public spending cutbacks. This belt tightening will reach construction budgets by the middle of next year.

Regionally, the construction downturn will be the most severe in the states that experienced the most sev housing recession in 2006-08. This is because their housing recoveries will be delayed as much as a year, the need for related infrastructure has been declining, and the capacity to finance the infrastructure has also declined. This includes California, Nevada, Arizona, Florida, Michigan, Ohio and Rhode Island. Conruction will be relatively stronger in the middle of the country from Texas to the Dakotas. These states have rising incomes from energy and farming industries and large enough “rainy day funds” in their public budgets to prevent significant cutbacks in construction projects.

| 2009 Construction Spending to Increase 0.7% | |||||

$ Billions | Annual % Change | ||||

2009 | 2007 | 2008 | 2009 | ||

| Total Construction Spending | 1082.7 | -2.9 | -5.3 | 0.7 | |

| Residential New | 236.1 | -26.4 | -16.6 | -3.5 | |

| Residential Improvements | 119.2 | -3.6 | -11.3 | -4.4 | |

| Non-Residential * | 456.8 | 17.6 | 12.2 | 1.2 | |

| Nonbuilding | 270.6 | 10.8 | 12.4 | 6.0 | |

| Source: U.S. Commerce Department Forecast: Reed Construction Data | |||||

| Heavy Construction Trends | ||||||

$ Billions | Annual % Change | |||||

2009 | 2007 | 2008 | 2009 | |||

| Total Heavy Construction | 270.6 | 10.8 | 12.4 | 6.0 | ||

| Highways & Streets | 84.0 | 4.9 | 4.0 | 7.3 | ||

| Power | 76.7 | 32.5 | 29.5 | 12.2 | ||

| Transportation | 35.8 | 15.6 | 10.0 | 0.9 | ||

| Communication | 24.6 | 21.2 | -3.9 | -5.0 | ||

| Water & Sewer | 44.0 | 1.6 | 8.2 | 5.0 | ||

| Conservation & Development | 5.5 | 2.3 | 0.5 | 4.0 | ||

| Source: U.S. Commerce Department Forecast: Reed Construction Data | ||||||

| Nonresidential Trends and Outlook | ||||||||

$ Billions | Annual % Change | |||||||

2009 | 2007 | 2008 | 2009 | |||||

| Total Nonresidential | 456.8 | 17.6 | 12.2 | 1.2 | ||||

| Education | 102.7 | 12.9 | 7.6 | -0.7 | ||||

| Commercial | 84.9 | 15.4 | -0.9 | -3.2 | ||||

| Office | 75.3 | 19.4 | 12.3 | 3.5 | ||||

| Health Care | 48.0 | 11.5 | 6.2 | 5.4 | ||||

| Amusement & Recreation | 20.5 | 13.8 | 5.2 | -9.8 | ||||

| Manufacturing | 66.4 | 21.1 | 47.4 | 5.8 | ||||

| Lodging | 39.5 | 59.0 | 31.1 | 5.3 | ||||

| Public Safety | 13.2 | 26.5 | 23.9 | 7.7 | ||||

| Religious | 6.7 | -3.8 | -7.7 | -6.7 | ||||

| Source: U.S. Commerce Department Forecast: Reed Construction Data | ||||||||