Still Tough Times

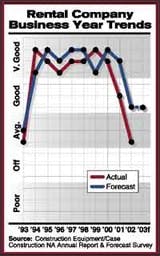

Business on the rental-dealer side continues sluggish, with 2002 turning out "average" for the industry. Volume growth took a hit, and margins continue to drop across the industry.

Rental dealers had forecast a volume growth trend for 2002. It not only failed to materialize, but also turned into a negative trend. Although 16 percent saw volume increase, 28 percent said it fell off for a net of negative 12 percent. This year should fare better as 35 percent forecast volume growth against only 6 percent saying it will decline.

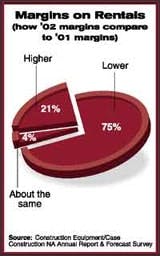

That lack of volume just put additional pressure on margins for rental dealers. Again, margins dropped this year, and the percentage of dealers reporting margins dropping "much lower" increased from 26 percent in 2001 to 31 percent last year, the second consecutive year that has happened. All told, 75 percent of rental dealers say margins were lower last year than in 2001.

Twenty-one percent label "declining rental prices" as their single most pressing concern. In 2001, 36 percent forecast that they would raise rates in 2002, yet only 25 percent actually did. For 2003, 41 percent of rental dealers say they'll raise the rates they charge to rent their equipment.

But expect volatility in rates as more dealers drop their rates. Last year, 20 percent decreased rental rates, and 22 percent say they'll decrease rates this year.

This, perhaps, is in direct response to the competitive nature of the rental business these days. Some 63 percent report "intense" or "very intense" competition in their areas.