Heavy Equipment Distributors Return to the Economic Valley

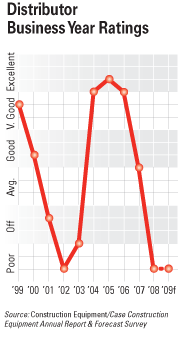

Look at the accompanying line graph and one wonders how heavy equipment distributors sleep at night. It has been a ride worthy of any rollercoaster daredevil this decade, and results for 2008 harken back to the post-9/11 recession. Unlike that valley, equipment dealers do not see an up-tick for the following year.

Construction equipment distributors forecast that 2008 would be “average,” but the year’s business rating hit the bottom of “poor.” Few regions disagreed with the general consensus, and only one region expects 2009 not to be “poor.”

All respondents are members of the Associated Equipment Distributors, who once again partnered with Construction Equipment for this report. The percentage of distributors who reported declines in sales volume negated the percentage who reported gains, leav-ing a net of 1 percent (45 percent saw increases minus 44 percent reporting decreases). Far fewer (29 percent) forecast sales increases for 2009, which, when put against the 52 percent who anticipate sales volume to decrease this year, leaves a net of -23 percent.

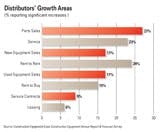

Parts sales was a sales brights spot for distributors last year: 27 percent reported signifi-cant increases in volume. Rent-to-rent and service were recorded by slightly fewer dis-tributors, 24 percent and 23 percent respectively, as significant volume gainers. The per-centage of distributors reporting volume jumps in new-equipment sales plummeted from 31 percent in 2007 to 17 percent last year.

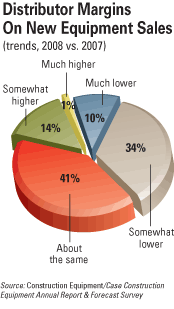

Margin declines on new-machine sales were not as precipitous. The percentage of distributors reporting in 2008 the ability to increase margins was similar to those in 2007: 15 percent to 16 percent. On the declining margin side, 44 percent of distributors said new-machine margins were lower in 2008, compared to 39 percent in 2007. Comparing the increases to decreases provides a 2008 net of -29 percent, compared to a net of -23 percent.

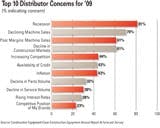

Eight in 10 distributors cited recession as the top business concern for 2009, up from six in 10 last year. Other top business concerns are declining machine sales (70 percent re-sponding), poor margins on machine sales, and decline in construction markets (each at 61 percent).