Give Me the Ball, Coach

It is third and goal on the 5-yard line with two minutes to go, and you are four points behind. You say to your coach, “Give me the ball, Coach. I can get the job done.” Do you have the confidence to make the play and win the game?

Seldom in our business do you come across someone who calls for the ball and asks to carry the risk in a tight situation. This is especially the case in today’s world, but I came across one the other day. We were discussing fleet utilization, and the chief operating officer of the company said, “Give me the responsibility for fleet utilization. I’ll manage it, and I will get it right.” The conversation turned from negative to positive, and what is normally a hard conversation about minimum weekly hours, back charges, and underreported hours turned into a positive goal-setting process that will bring the company together and improve performance.

We know that the vast majority of owning costs are fixed annual charges and that the hourly owning-cost rate is therefore almost entirely dependent on hours worked in a year. Let’s take a loader with an hourly rate of $120 split $40 per hour for owning costs, $45 per hour for operating costs, and $35 per hour for fuel.

Let’s assume that the annual fixed costs to cover depreciation, loan repayment, licenses, insurances and property tax for the loader are $72,000, and that the machine was expected to work 1,800 hours per year when calculating the $40 per hour owning rate ($72,000 ÷ 1,800 hours = $40 per hour). There is little room to spare: We would have to work 36 hours per week for 50 weeks of the year to work 1,800 hours and recover our annual fixed costs.

The rate calculation is fine, but who carries the risk if utilization falls below 1,800 hours for the year? It is a substantial gamble. If utilization drops from the 1,800-hour target to 1,200 hours, then the owning portion of the rate increases by 50 percent, from $40 per hour to $60 per hour. The change is not the equipment manager’s fault since the equipment folk cannot manage utilization. It is not a risk the jobs want, because they are working as hard as they can and they absolutely must have the machine on site to do the last bit of unproductive work needed before switching to traffic in two weeks.

Regardless, if the rate stays the same and utilization drops to 1,200, the company will be under-recovered $24,000 on the fixed cost of ownership for this one machine alone (1,800 hours – 1,200 hours = 600 hours underutilized time at $40 per hour). It is not a good situation: The equipment group appears greedy if they increase the rate or back charge the jobs, and the jobs are accused of hoarding equipment if they do not get minimum hours and the company is in the hole. What do we do about it ?

Many companies have what I call a “make-up time rule.” The most draconian rules require that the jobs pay for the machine for a minimum of 40 hours (or some other number, sometimes 30, sometimes 50) per week regardless of actual utilization. Other rules stipulate that “make-up time” applies only to the owning portion of the rate. Still others stipulate that if there is a “penalty” when machines are underutilized then there must be a “bonus” when machines are over-utilized. Regardless, make-up time rules cause a lot of conflict and are a cancer that eats at relationships between operations and equipment. Make-up time charges can, and often do, introduce significant errors in job costs because it is difficult, if not impossible, to determine correct activity cost code when posting significant charges for idle equipment. They are seen as retrospective and punitive and often give rise to underreported working hours because “who cares, we are going to be charged any way.”

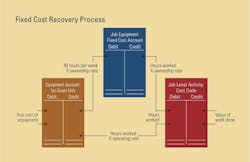

The diagram at top sets out a solution to the problem. It is slightly more complicated than the normal process and relies on the establishment of a Job Equipment Fixed Cost Account as shown by the blue area in the top center of the diagram. This account, as with all job-level cost accounts, is set up at the start of the job and is the responsibility of the project team.

The process works as follows:

- An amount equal to 40 hours per week times the ownership rate for each machine is calculated and debited to the Job Equipment Fixed Cost Account at the start of each week. The project team has said, “Give me the ball, Coach.” They know the amount in advance, they know the goal and accept the challenge of recovering the fixed costs of all the equipment they have on site.

- The equivalent amount is credited to the Equipment Account for each unit. This means that the estimated annual fixed costs for the equipment on the job is recovered, and as long as the units are deployed on site, no fixed cost recovery risk remains in the equipment account.

- The job site goes to work, generates value from the work done, and records the number of hours each machine has worked. Hours worked times the O&O rate generates a debit to the Job Level Activity Cost Code. Hours worked times the ownership rate generates a credit to the Job Equipment Fixed Cost Account and helps the project team achieve the goal of recovering fixed costs. Hours worked times the operating rate generates a credit to the Equipment Account for each unit and helps the equipment group recover true operating costs of the equipment.

- Any balance on the Job Equipment Fixed Cost Account at the end of the week is carried forward and either reduces or increases the challenge to be met by the project team in the week ahead.

It is pretty simple. Although a few more automated and computer-generated transactions are involved, the advantages well outweigh the additional work. Principal among the advantages are:

- The annual fixed cost of equipment to be recovered on each job each week is clearly defined, made a clear project responsibility, and managed in a separate account. This puts the spotlight on a critical equipment-ownership issue and gives the risk to the project team who can and should manage it.

- The amount to be recovered on each job each week is known in advance and set as a clear challenge to the project team. They are in a position to manage the account proactively by achieving high levels of utilization (hours worked per week) or by sending equipment off site to reduce the debit they experience. The company eliminates retrospective, negative and punitive make-up time charges.

- The Job Equipment Fixed Cost Account for a job can be given an appropriate budget at bid time if it is felt that the job will experience significant weather impacts or delays or if there are plans to work extended shifts. The balance on this account becomes a key job-level performance metric.

- Operations and equipment share in the goal and benefit from accurate recording and reporting of hours worked. Good and accurate data help the job correctly generate credits to their Job Equipment Fixed Cost Account. Good and accurate data help the equipment group correctly generate credits to each unit’s operating and overall cost accounts. The company moves away from all the problems caused by underreported hours and is therefore in a position to generate accurate production, equipment cost, and job cost records. Neither job costs nor equipment costs are affected by make-up time charges.

- The system can easily be extended to measure and manage down hours. Down hours times ownership rate generates a credit to the Job Equipment Fixed Cost Account and a debit to the Equipment Account. The job does not carry the responsibility for fixed-cost recovery on down equipment, the cost of which is now carried as a clear and explicit entry in the equipment unit level cost report.

The approach adds a little complexity to the way internal costs and charges are set up, but it has clear advantages and significant potential to remove and resolve a real issue. It places the ball for fixed-cost recovery in the hands of operations managers and asks them to win the game. It leaves equipment managers free to run their own plays and win their own game by maximizing reliability and availability at competitive cost.