Last year’s optimism about growth in the nonresidential building sector has been overwhelmed by a novel coronavirus whose persistent spread raises questions about business prospects for next year and beyond.

Construction spending will be off by 8.1 percent in 2020 and 4.8 percent in 2021. That’s the consensus among nine market watchers—ranging from the Associated Builders and Contractors to IHS Economics—whose projections were aggregated in the American Institute of Architecture’s (AIA) mid-year Consensus Construction Forecast, released in July.

Caulfield is senior editor for Building Design+Construction.

With the exceptions of healthcare and public safety, every major building category is expected to lose ground this year and next. This trend would end an almost decade-long expansion in construction spending.

Things weren’t looking much better as summer turned to fall. The total value of construction put in place as of September 2020, $794.3 billion, was down 4.4 percent from the same month in 2019, according to Census Bureau estimates. The office building category alone was off 15.4 percent. Education, the largest nonresidential building sector, declined 4.8 percent.

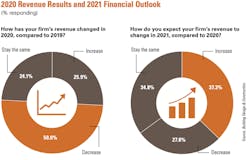

A recent BD+C survey of architects, engineers, and contractors reflects these broader outlooks. Half of those polled reported that their firm’s revenue was less, compared to 2019. Nearly one-third gauged their firm’s financial health as “weak or very weak.” Two-fifths describe 2020 as a “mediocre” or “poor” business year. More of the same in 2021 is expected by 31.1 percent.

Read the complete industry report in 2021 Annual Report & Forecast.

But it’s not all gloom and doom. More than one-quarter of respondents say their firms have found market penetration points that have allowed them to generate more revenue than in 2019. A surprising 28.3 percent of survey respondents rated 2020 as an “excellent” or “very good” business year. About the same portion is anticipating 2021 to be similarly robust, with 37.3 percent expecting revenue increases next year.

With construction projects being delayed or postponed because of the virus, competition has ratcheted up. Nearly 60 percent of respondents characterize their markets as “intensely” or “very” competitive. And there has been very little relief in materials prices during the pandemic: nearly three-quarters of respondents—73.1 percent—expect prices to keep rising next year. One-fifth think prices will level off.

BD+C asked firms to weigh in on business prospects for 2021 in several building sectors. Here are some of the high (and low) points:

- 55.6 percent of respondents see immediate prospects for the hospitality sector as “weak” or “very weak.”

- 58 percent of respondents think prospects for the retail sector in 2021 are “weak” or “very weak.”

- More than half of the survey respondents whose firms operate in the office sector expect business prospects to be “weak” or “very weak” next year.

- Nearly one-third of respondents expect prospects in the industrial sector to be “excellent” or “very good.”

- Nearly 40 percent of the survey’s respondents that serve the multifamily sector said it will be an excellent or very good market next year.

- More than one-third say the data centers and mission-critical facilities markets will be “excellent” or “very good” in 2021.