Coronavirus Causes Caution Among Fleets

Covid-19 slammed into machine acquisition plans in March, causing equipment managers to put on hold planned efforts to replace or grow their construction equipment fleets. The response, of course, was to the economic effect of the coronavirus, which resulted in shut downs, furloughs, and rank uncertainty about the rest of the year. (More on how fleets responded to the pandemic.)

Construction Equipment sent email invitations to select members of our audience who buy, specify, or influence purchases of equipment. We asked about business and equipment-fleet trends. Results and analysis are provided as a service to the industry through the partnership of Construction Equipment and Case Construction Equipment.

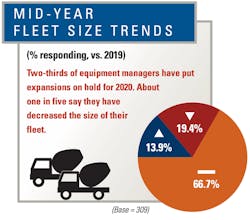

Fleet managers have recalculated their fleet expansion plans, with 19.4 percent decreasing fleet size this year and 13.9 percent increasing, for a net of -5.5 percent (percentage expecting an increase minus those expecting a decrease). The net forecast in our 2020 Annual Report & Forecast was 30.8 percent. Even so, two-thirds of respondents say 2020 fleet size is the same as in 2019. Fleet condition remains positive, with 41.7 percent rating fleet condition as either “excellent” or “very good.” In January, fleet condition was rated “excellent” or “very good” by 48.5 percent of respondents.

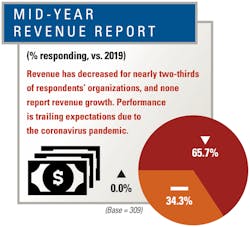

Respondents report revenue growth far below forecasts half-way through 2020. In January, fleet managers were upbeat regarding revenue growth, with a net of 47.4 percent. That net has been reduced to -65.7 percent, with none reporting growth so this year.

The percentage of respondents rating the business year as “excellent” or “very good” is 49 percent, compared to a forecast for 2019 of 52.5 percent.

Mid-year Fleet and Business Trends