Contractors Mystified by 2009 Economic Outlook

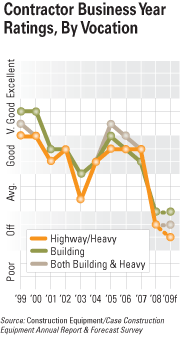

Last year, we reported that contractors’ conservative forecasts paid off when the residential construction market slowed, enabling them to meet their forecast when they rated the actual business year for 2007. But there was little to prepare highway/heavy and building contractors for what happened the following year, in 2008. And because our survey results were tabulated the week before the Federal government announced its bank bailout plan, this year’s rating may not fully take into account the total effects of the credit crisis on the construction outlook. Nonetheless, contractors rated 2008 as an “off” business year.

The level of uncertainly among respondents, however, kept their outlooks for 2009 prospects low. Surely, contractors were well aware of tightening credit markets before the rest of the country experienced the bailout debate. This year, contractors expect their construction business to match 2008’s rating of “off.”

We categorize contractors as highway/heavy, building or diversified (engaged in both). Each rated the year similarly, with slightly higher ratings from building contractors, perhaps riding recent nonresidential construction strength. They, along with diversified contractors, look for identical business ratings for 2009. Highway/heavy contractors, however, look for a dip in 2009’s rating.

The future of highway and other public spending is uncertain following the massive amount of public funds spent on bank bailouts and rescue plans, the details of which had not been worked out prior to the contentious presidential election. Add to this the expiration of the current transportation funding bill and declining tax receipts at the state and local level, and contractors can’t help but be mystified by their prospects for 2009.

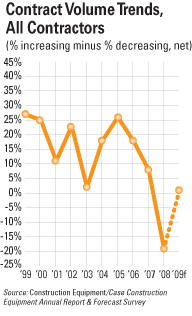

As contractors looked forward to 2009, contract volume trends were bleak. Last year, 45 percent of contractors reported that contract volume was lower than it was in 2007. About 26 percent reported higher volume, for a net of -19 percent. This was the lowest net (percent increasing minus percent decreasing) in more than 10 years and well off the net of 19 percent projected for 2008 volume. The forecast for 2009 is also the lowest in years. Twenty-nine percent expect volume to decrease over 2008 levels, and 30 percent expect it to increase for a net of 1 percent.

Broken down by contractor type, work volume trends for 2009 differ. Both diversified and highway/heavy contractors expect volume decreases, with nets of -7 percent and -5 percent, respectively. Building contractors, however, report a net of 7 percent with 33 percent expecting volume increases minus 26 percent expecting decreases.

Regional differences are even more pronounced. Again, contractors as a whole expect 2009 volume to net at 1 percent. Only the Mid-Atlantic region is lower than that, and four of the remaining eight right around that 1 percent net. The remaining four regions (Southern Plains, Mid-South, South Atlantic, Mountain) contain more contractors forecasting growth than those forecasting volume declines. In fact, 53 percent of Mid-South contractors report growth minus 18 percent who report declines for a net of 35, by far the most positive outlook in the nation.

One in five contractors will be fighting for volume in “intensely competitive” markets this year, and an additional 55 percent in “very competitive” markets. Only 5 percent say their market is “not very” or “not at all” competitive.

On the other hand, 9 percent of contractors rank their company’s overall health on the low side, choosing either “weak” or “very weak” to describe it. Some 58 percent rate company health as “very good” or “good.” Highway/heavy firms are rated similarly by 65 percent of respondents, followed by 57 percent of building contractors and 55 percent of diversified contractors.

Fleet Trends

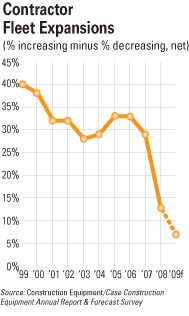

Fleet size did not drop as volume dropped, according to contractor respondents. About three in 10 reported fleet size growth, in terms of number of machines, in 2008. Subtract the 14 percent who reported fleet shrinkage, and the net was 13 percent. Last year was the lowest net (difference between those growing fleet minus those decreasing) in more than 10 years (including the 2002-03 recession years), and below the 20 percent net forecast, indicating that contractor equipment managers are watching cost of this substantial asset fleet. In fact, 2009’s projected trend drops into the single digits, with a net of 7 percent. Some 18 percent expect to grow their fleet, but 11 percent expect to decrease the size. Of course, that leaves 72 who expect fleet size to remain the same as 2008, but there’s little doubt contractors are keeping a close eye on fleet size.

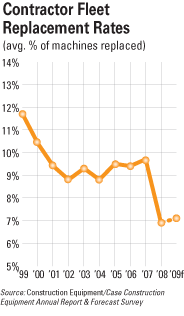

Replacement rates, a measure of how fleets are updating their fleets, also dropped in 2008 to the lowest level in a long time. Fleet managers expected to replace an average of 8.9 percent of their fleets in 2008 but instead replaced only 6.9 percent. Expectations are flat for this year, too, with a replacement rate forecast of only 7.1 percent.

This slowdown in replacement rate and fleet size didn’t affect fleet condition last year, according to respondents. Thirty-nine percent reported their fleets were in “excellent” or “very good” overall condition last year, comparable to the numbers reported in 2007. The low end of the scale were also comparable, with 14 percent reporting fleets in “fair” condition.

As emissions compliance continues to grow as an issue, fleet managers will need to look more closely at replacement rates and fleet condition. California requirements, sure to move to other states, strongly favor the replacement of less-compliant machines. For about one-third of contractors who responded to our survey, the equipment manager has primary responsibility for compliance. A similar number of respondents, however, said no one has official responsibility.

Machines costing more than $25,000 are acquired primarily by purchase, either outright or through financing, for 52 percent and 43 percent of respondents, respectively. Sixteen percent use rental-purchase agreements, 13 percent use lease-purchase. Short-term rental (defined as less than one year) is used by 16 percent of contractors to acquire these machines, too.

For equipment of any price, short-term rental is an acquisition option for 64 percent of contractors. Sixty percent of contractors rent light earthmoving equipment such as skid-steer loaders and backhoe loaders, which is by far the most popular machine category. Other machines rented by contractors are light equipment (44 percent), compaction equipment (33 percent), air compressors and generators (33 percent), and work platforms (27 percent).

Workforce trends last year were the reverse of 2007, when the net (percent increasing workforce minus percent decreasing) was 9 percent. In 2008, 32 percent of contractors reported a total workforce smaller than in 2007 and 21 percent said it was larger, for a net of -11 percent.