Construction Expands, Project Mix Changes

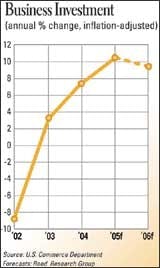

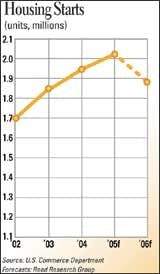

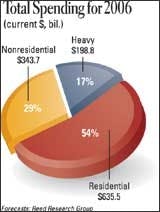

Real construction spending after inflation will grow about 3 percent in 2006, slightly slower than the overall economy for the second year in a row. Including inflation, spending will increase 6 percent in 2006 after an estimated 8.4-percent gain in 2005. As new-residential construction slows this year, growth shifts as nonresidential and heavy enter into a multi-year expansion.

Construction inflation will be lower this year with only cement and concrete product prices certain to rise substantially. High materials prices were a serious problem for contractors last year. The abrupt price increases between the planning and construction phases changed project finances enough to cause the delay or cancellation of some tax- and bond-funded projects as well as private projects built to be leased. Yet the timing of the price increases — a big burst early in 2004 during the world commodity shortage and a smaller burst late in 2005 after the hurricanes — means that 2006 began with the materials price index only about 3 percent above a year earlier compared to more than 12 percent at the beginning of 2005.

Materials prices are now perceived to be high, but there is no domestic or worldwide inflation driver that will cause another period of accelerated inflation. Energy-based prices will be declining slightly in 2006, although they remain very high. Plastics prices may be an exception, because the price of the natural gas feedstock for petrochemicals jumped 50 percent when one-third of the natural gas production in the Gulf of Mexico remained shut for two months after Hurricane Katrina. The adequacy of natural-gas supplies is precarious. A cold winter will quickly boost the already high prices of all plastics construction products.

Construction spending is forecast to strengthen over the course of the year and into 2007 because most of the expected decline in new-home construction spending will occur late in 2005 or early in 2006. The forecast rise in nonresidential and heavy construction spending will continue into at least 2008 as work continues on new projects started in 2006–07.

The strongest regional economies in 2006 will again be the Atlantic and Pacific states with the interior states lagging. The fastest-growth job and construction markets will be in the northeast from Norfolk to Boston, especially in Washington; south Florida; and southern California, spilling into Nevada and Arizona.

Houston and Baton Rouge have a substantial boost from the influx of New Orleans evacuees. But the rebuilding of public and commercial facilities and homes in the New Orleans area will be slow and much less complete than the rebuilding of private energy and transportation facilities.

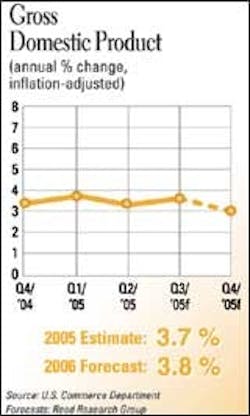

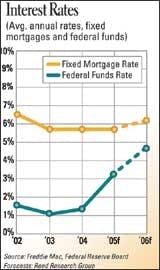

The favorable economic environment for construction continues through 2006. Growth in 2005 gross domestic product will be about 3.5 percent. Growth will be more than 4 percent early in 2006 as spending rebounds from the impact of the hurricanes. But it will slip to nearly 3