Construction Costs Index Falls in October

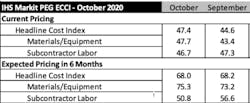

The IHS Markit PEG Engineering and Construction Cost Index registered 47.4 in October, indicating prices for materials, equipment, and subcontractors dropped in the month.

The materials and equipment sub-index recorded the eighth consecutive month of falling prices, with survey respondents reporting price declines for seven out of the 12 components. Ready-mix concrete recorded another month of flat pricing. Copper prices continued rising, marking the fourth month of price increases. This month, turbine prices increased for the first time after falling for the previous six months. Ocean freight (from Asia to the U.S. and Europe to the U.S.) prices continued to show strength.

“Containerized freight rates faced upward pressure in the second and third quarters as carriers enacted capacity contraction measures via blank sailings to prevent rates from falling too low due to the Covid-19 pandemic,” said Tal Dickstein, senior economist, IHS Markit, in a prepared statement. “Spot rates jumped as demand rose in May and June in conjunction with lockdown restriction easing in the United States. Looking ahead, we expect fewer blank sailings; spot rates along the Asia to U.S. routes will reflect this change in supply-demand equilibrium with price pressures easing in the near term.”

The sub-index for current subcontractor labor costs came in at 46.7 in October. Labor costs were flat in the Southern U.S. and Eastern Canada, and rose in the Northeast U.S. Labor costs fell in the Midwestern and Western U.S. and Western Canada. The index readings reflect continued slack in labor markets as economic fundamentals keep demand for new projects muted.

The six-month headline expectations for future construction costs index was above the neutral mark again in October, at 68.0. Both the materials/equipment sub-index and the labor sub-index recorded expectations of future price increases. The six-month materials and equipment expectations index came in at 75.3 this month, up from 73.2 last month, with respondents expecting increasing prices for all 12 categories. Expectations for sub-contractor labor registered 50.8 in October, barely above the neutral mark. Labor costs are expected to stay flat in Western Canada and fall in Eastern Canada; U.S. labor costs are expected to rise in the South and to stay flat in the Northeast, Midwest, and West.

In the survey comments, respondents continued to note lower demand conditions due to the coronavirus and no shortages for most categories.

Source: IHS Markit