Budget Growth Remains Flat

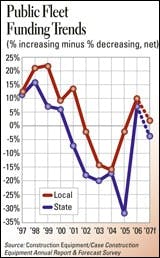

Government fleet funding leveled off overall in 2006, but it's too soon to say whether or not the slide has been stopped altogether. About 29 percent of fleets reported increases in funding for their fleet operations, but 20 percent saw decreases for a net of 9 percent. This is better than the year before, and it is better than anticipated. The net for 2006 was expected to be only 4 percent.

Local fleets reported a net of 10 percent for 2006 (29 percent increasing funding minus 19 percent decreasing), and states saw a net of 7 percent (29 percent increasing minus 22 percent decreasing).

For this year, expectations remain conservative. Among local fleets, 25 percent expect funding increases, but 23 percent see decreases for a net of only 2 percent. State fleets have a net of -4 percent (20 percent increasing minus 24 percent decreasing). Overall, 2007 funding is estimated to increase by 24 percent of government fleets and decrease by 23 percent, for a net of 1 percent.

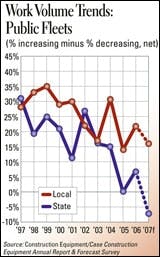

Work volume, however, was and is not going to be flat for government fleets. Last year, 31 percent reported increased work and 11 percent reported decreased, for a net of 20 percent. Local fleets work volume increase was a net of 22 percent of respondents; states was 7 percent. This year, fewer respondents see volume growing, with a net of 13 percent (25 percent reported increase volume minus 12 percent decreasing).

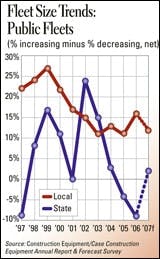

Fleet size stayed consistent last year, and is anticipated to stay flat this year, too. In 2006, 70 percent of fleets saw no change in fleet size, measured in number of machines. Among those that did, 21 percent saw increases and 9 percent saw them decrease for a net of 12 percent. This year is no different, with 73 percent saying machine counts will stay at current levels. Again, among the others, the net is 10 percent (19 percent increasing size minus 9 percent decreasing). Local fleets anticipate fleet growth among 19 percent of respondents, and when the 6 percent who expect decreases in size are subtracted, the net is 12 percent. On the state side, the net is 3 percent (19 percent growing minus 16 percent shrinking).

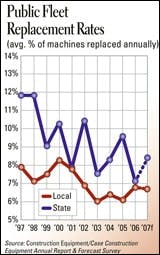

State and local fleets replaced machines at about the same rate last year, but state fleets will bump their rate in 2007. Overall, government fleets reported a replacement rate of 7.1 percent. This year, fleets expect to bump that to 7.2 percent, with state fleets shooting for 8.4 percent and locals at 6.7 percent.

Fifty-one percent of government fleets rate their condition as "excellent" or "very good," an increase from 2005 when 47 percent of government fleets were rated that way. State fleets tend to be rated lower than local fleets. State fleets, in fact, are rated "fair" or "poor" by 18 percent of respondents; locals by 12 percent.

Short-term rental is a viable and oft-used strategy for government fleets, with 59 percent reporting that they rent machines for less than one year. This is up slightly from last year. Of those who do rent, the majority (72 percent) rent the same amount in terms of machine hours.

In noting which machine types are most likely rented on a short-term basis, government fleet managers reported light earthmoving equipment (45 percent), light equipment (32 percent), compaction equipment (30 percent), heavy-earthmoving equipment (27 percent), and work platforms (25 percent).

Major machines, those whose purchase price exceeds $25,000, are acquired by outright purchase by 83 percent of government fleets. All other strategies are reported used by fewer than 20 percent of these managers: short-term rental, 15 percent; lease/purchase, 15 percent; financed purchases, 13 percent; leasing, 8 percent; and rental/purchase, 5 percent.

Mary—I cut captions on page 17, so you can move the charts up one line. That eliminates these 2 lines