All Cylinders Firing

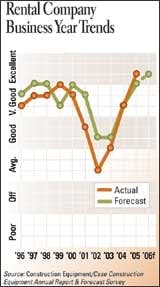

Not only did rental dealers exceed their high expectations for 2005 and have an "excellent" year, but they also increased margins and rental rates.

In our survey of members of the American Rental Association, we found an enthusiastic report. Seven of nine regions reported that 2005 was an "excellent" year.

Sales volumes jumped last year, with the percentage of dealers reporting increases minus those reporting decreases netting out at 63 percent. Few dealers reported sales decreases at all.

Nearly half of the respondents reported significant increases in short-term rentals. Other significant gains were recorded in new-equipment sales, parts sales, and service volume.

The outlook for 2006 is just as enthusiastic. Business is expected to again be "excellent," and continued growth in sale volume is anticipated. The net (percent expecting increases minus percent expecting decreases) is 45 percent.

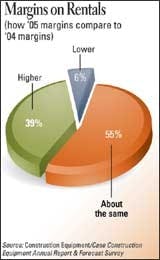

Dealers took advantage of the stellar year to boost margins with 39 percent citing higher margins for 2005.

Rates also rose in 2005, with 58 percent of dealers reporting higher rates. An astounding 70 percent expect to raise rental rates this year.

Of course, with this much rental activity to share, competitiveness waned a bit. Although six in 10 dealers say competition is "intense" or "very intense," this is less than in 2004. Half of dealers say competition is a concern for 2006.

Financial and economic worries top the list of business concerns for this year. Interest rates are a concern for 63 percent of rental dealers; 50 percent cite inflation; and 46 percent worry about recession.