Continued Growth In Nonresidential Revenue Projected

Nearly half of the respondents (46.1 percent) to our survey of AEC professionals reported that revenues had increased last year compared to 2012, with another 24.2 percent saying cash flow had stayed the same.

The majority (56.8 percent) of respondents—architects, engineers, contractors, buildings owners, and others in the commercial, industrial, multifamily, and institutional field—said their firms would bump up revenues in 2014, with 31.4 percent saying business would stay the same, and only 11.8 percent predicting business would decline.

More Annual Report & Forecast

A majority (55.5 percent) also rated the health of their firms as good (35.6 percent) or very good (19.9 percent).

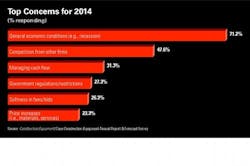

As has been the case in recent years, the overwhelming majority (71.2 percent) rated “general economic conditions (i.e., recession)” as the most important concern their firms will face in 2014. The margin of error is about 3.5 to 4 percent.

Competition from other firms went up as a factor for the third year in a row, to 47.6 percent (44.9 percent in 2012, 40.1 percent in 2011). Nearly four in five respondents (79.3 percent) described the current business climate for their firms as “very” to “intensely” competitive; that’s up somewhat from 73.4 percent in 2012 and 74.8 percent in 2011. But “having insufficient capital funding for projects” declined slightly, to 24.1 percent of respondents, down from 29.7 percent in 2012 and 34.5 percent in 2011.

Data centers continue surge

Asked to rate their firms’ prospects in specific construction sectors on a five-point scale from “excellent” to “very weak,” respondents gave data centers high marks. (Note: Respondents who checked “Not applicable/No opinion/Don’t know” are not counted here.) Among the findings:

- Data centers and mission-critical facilities continued to show strength, with the majority (56 percent) of respondents in the good/excellent category, compared to 52.1 percent last year and 45.2 percent the year before.

- Healthcare continued its leadership as the most highly desirable sector, with more than three in five respondents (62.5 percent) giving it a good to excellent rating, up from 58.8 percent last year.

- The apartment boom registered with AEC professionals, who gave multifamily housing a 56.1 percent good/excellent rating.

- Industrial/warehouse facilities keep moving up in the AEC psyche, registering a 33 percent interest level on the good/excellent scale, a significant climb from last year’s 25.5 percent.

- Retail commercial construction also showed vitality. Nearly a third of respondents (31.4 percent) came out on the good/excellent side for the coming year, well up from last year’s 19.9 percent rating.

- Nearly two-thirds of those surveyed (66 percent) said senior and assisted-living facilities looked like good/excellent prospects for their firm, significantly up from last year’s healthy 50.5 percent.

- College and university facilities got the nod from 44.8 percent of respondents on the good to excellent scale, up from 37.8 percent last year.

As for government/military projects, the survey was taken before the full impact of the sequestration was known. The sector was rated good to excellent by 33.7 percent of respondents, much along the lines of last year’s 36.1 percent of respondents, and down slightly from the previous year’s 41.1 percent.

While the construction of new office buildings drew tepid response (26.9 percent) in the good/excellent scale, that was still significantly up from last year’s 15.6 percent rating. However, a solid majority (52.1 percent) of respondents said office fitouts and interior renovations looked good to excellent for 2014. That was likely a statistically significant leap from last year’s 35.7 percent who said

office interiors would be a strong sector.

In fact, reconstruction, historic preservation, and renovations accounted for at least 25 percent of work for more than a third (38.5 percent) of respondents, up slightly from the 34.6 percent registered last year and roughly the same as the year prior (36.3 percent).

K-12 schools perked up a bit, with 30.9 percent saying the sector looked good to excellent for 2014, compared with 22.9 percent last year and 23.2 percent the year before.

Technology’s demands

What about BIM? Is its promise holding true? Somewhat surprisingly, more than one in five respondents (22.7 percent) said their firm did not use building information modeling, about what was recorded over the previous two years.

Remarkably, precisely the same percentage of respondents (26.8 percent) said their firms used BIM in the majority of projects based on dollar value, as in the last two annual surveys. Nearly two in five (39.8 percent) said their firms’ use of BIM would be rising in the coming year; two-fifths (42.2 percent) of respondents said their companies would be investing more in technology in 2014.

Of the 400 who gave their professional description, 45 percent were architects; 8 percent, engineers; 28.8 percent, contractors; 9.8 percent, building owners, developers, or facility/property managers; and 8.6 percent, consultants or “other.”