Breaking It Open

Equipment distributors burst through business barriers last year, and there is no sign of slowing. After three years of horrendous business reports ("off" and "poor," distributors blew by their conservative forecast for 2004 of "good" to report a "very good" year. Expectations are for more of the same this year.

Members of the Associated Equipment Distributors reported overwhelmingly that volume increases ruled the year last year. Almost half of distributors reported unchanged volume in 2003, so the two-thirds who reported volume growth in 2004 experienced the turnaround. Only 5 percent reported volume decreases, for a net of 62 percent. For this year, 41 percent expect continued growth, with 1 percent citing decreasing volume, for a net of 40 percent.

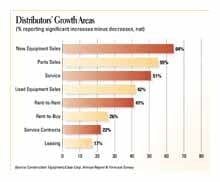

Volume growth last year was significant across most business areas about which we ask: 64 percent reported increases in new-equipment sales; 55 percent in parts sales; 51 percent in service business; 42 percent in used-equipment sales; and 41 percent in rent-to-rent business.

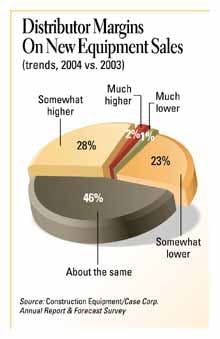

With such positive activity in new-equipment sales, 30 percent of distributors reported increased margins in 2004 compared with 2003. Although fewer reported decreasing margins, the fact that one in four did raises some concern that volume increases may not be translating into profitable growth.

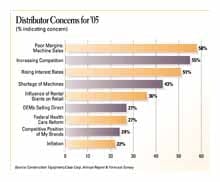

In fact, poor margins on machine sales was the No. 1 business concern in 2004, followed closely by increasing competition and rising interest rates. Even with machine shortages (which 43 percent cited as a concern), the margin pressure remains high.