Optimism Grows for Transportation Contractors

As 2022 drew to a close, optimism ran high in the roads and bridges construction industry. The U.S. Department of Transportation began to roll out the Infrastructure Investment and Jobs Act (IIJA), and that influx of money—a $1.2 trillion infrastructure package that will deliver $550 billion in federal investments over five years—had a lot of people smiling.

See the complete 2023 Annual Report & Forecast.

However, not everyone was celebrating. There was some concern about the state of the industry, as well.

Most of the money in the IIJA will be allocated to states, which have final say in how it is spent. But the infrastructure law also offers new discretion and billions of dollars to the U.S. DOT. The Department received $120 billion to spend through new or expanding programs.

“There’s never been such a dynamic and fertile time to work on this because of the resources we have with the package,” Secretary of Transportation Pete Buttigieg told The Washington Post in October.

Most people working in the industry would agree.

In the state of the industry survey conducted by Roads & Bridges', respondents represented highway/heavy construction, both building and highway construction, general building construction, technology development, and material production.A whopping 89 percent of respondents said they expect business in 2023 to either be “excellent,” “very good,” or “good.”

“This is a moment of enormous opportunity with reason for optimism,” Buttigieg said in his prepared remarks to the House Transportation and Infrastructure Committee in July. “Thanks to the infrastructure law, my department has never seen a moment of greater potential than now—to build transportation resources that connect everyone safely, efficiently, and affordably to the things we need and the people we love.”

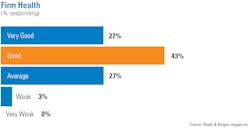

This positive outlook also is expressed when business owners talk about their firms. When asked about the overall health of their businesses, most respondents answered “good” (43 percent) or “very good” (27 percent). Another 27 percent described the state of their firms as “average.”

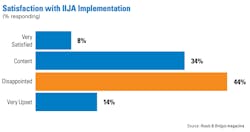

However, there is a gap between optimism and satisfaction with how the Biden administration is rolling out the IIJA. Most respondents (44 percent) said they were “disappointed,” while 34 percent described themselves as “content.” Nearly 14 percent said they were “very upset” by the rollout, and almost 8 percent were “very satisfied.”

Regardless of how they feel about the IIJA rollout, those in the roads and bridges construction industry have their work cut out for them, especially when it comes to the nation’s bridges.

There are 224,000 bridges in America that need repair, according to analysis the American Road and Transportation Builders Association (ARTBA) released in February. ARTBA also reports that one in three U.S. bridges needs to be repaired or replaced. In transportation terms, there are 167.5 million daily crossings on 43,578 structurally deficient bridges that have been rated in “poor condition.”

In 2022, two bridges collapsed and made national news. In January, the Fern Hollow Bridge on Forbes Avenue in Pittsburgh collapsed the same day President Biden was scheduled to visit the city to promote the IIJA. No one died in the collapse, but 10 people were injured.

In October, a bridge outside Kearney, Missouri collapsed, killing one person, and injuring three others. All four victims were trapped under debris from the bridge. Contractors were pouring concrete on the bridge deck when the bridge collapsed.

One of the issues with America’s bridges is the fact that contractors can’t repair them fast enough to keep up with the amount that are falling into “poor condition” each year. Nearly 50 percent of respondents said that the number of bridges on their list of those in “poor condition” stayed the same in 2022.

The need to improve our infrastructure is at a historic high, and though the IIJA has increased optimism about the jobs outlook, there is a considerable amount of concern about rising prices. Eight of 10 respondents (80 percent) anticipate material prices to go up next year. The same goes for bid prices, where 78 percent are bracing for higher prices.

The global supply chain crisis has slowed down the transport of materials and equipment. Along with inflation, many in the roads and bridges industry are concerned about a recession in 2023. If there is a recession, it could delay projects that are being funded by the IIJA. The economic forecast should become clearer by the end of the first quarter of 2023.

Unfortunately, even if a recession is avoided and the supply chain situation improves, the roads and bridges construction industry faces a much bigger problem in the ongoing labor shortage. Some 72 percent of respondents rated the availability of qualified workers for job openings as “weak” or “very weak.”

The industry has reasons to smile as the year ends, but 2023 might not be that easy.