For nonconstruction fleets, 2006 was mixed. Strong performance by utility and mining fleets overshadowed the materials producers' slowdown. Even so, all three vocations tracked by Construction Equipment were within range of expectations, and none of the three expects 2007 to be worse.

Here's how each of these vocations report on their fleets.

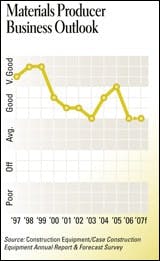

Materials producers' business year fell off in 2006, after posting a couple of years of comeback. The slowdown wasn't unexpected, so that was good news, but this year's expectations are equally weak, coming in at "average."

Regional differences are stark, too. Mountain responses for 2006 were "excellent," yet New England and Great Lakes respondents called the year "off." Although the Mountain region expected that kind of year, the other two regions were sorely disappointed, having called for a "good" year in 2006.

For this year, both regions expect another "off" year, joined by Mid-Atlantic, with the rest of the country downgrading expectations as well. Even so, the Mountain states expect a "very good" 2007.

Contract volume reflected the business ratings in 2006 as well as the expectations for 2007. Last year, 36 percent of materials producers saw volume increases, but subtracting the 30 percent whose volume decreased leaves a net of only 6 percent. This year, that net is 8 percent (30 percent expecting increases minus 22 percent expecting volume to decrease). Regions range from a net of -20 percent in the Mountain states to 27 percent in the Pacific.

Yet as business and volume slow, fleet growth continues for materials producers. As a group of equipment users, a net of 23 percent report fleet expansion (30 percent who increased fleet size in 2006 minus 7 percent who decreased). There were similarly positive nets across all regions. For this year, the net decreased to 18 percent (22 percent expecting to increase minus 4 percent decreasing).

Replacements rates, however, matched volume slowdowns, declining for the third year in a row and expected to decline again this year. Regional differences last year ranged from a 10.4-percent rate in the Southern Plains to 5.2 percent in the Northern Plains. For 2007, materials producers expect to replace 6.8 percent of their fleets.

Thirty-nine percent of materials producers rate their fleet as being in "excellent" or "very good" condition, and 15 percent say the condition is "fair" or "poor."

Fleet users in this vocation were optimistic last year, having come off two solid years of growth. The year met expectations, and they forecast another "very good" year for 2007. Three regions say this year will be excellent, and the rest forecast another "very good" year for mining & energy fleets.

Half of all mining & energy fleets reported that they had more work (measured in total machine hours) in 2006 than they did in 2005. Subtract the 9 percent who reported less work, and the net was 41 percent, slightly down from the net forecast for the year. Forecasts for this year are down a bit more, with 46 percent anticipating more work in 2007 vs. 2006. Subtract the 11 percent who say they expect less work, and the net is 35 percent.

Fleet expansion continued strong in 2006 and is anticipated to continue through this year. About 42 percent increased fleet size last year, measured in terms of number of machines, and only 3 percent decreased for a net of 39 percent. For 2007, increasing size outweighs decreasing by a net of 36 percent (37 percent minus 1 percent).

Fleet-replacement rate hit a 10-year high of 10 percent last year, and fleet managers expect to replace machines at an even higher rate in 2007: 10.9 percent.

Mining & energy fleet condition is "excellent" or "very good" for 48 percent of respondents, slightly more than the previous year. Those reporting "fair" or "poor" fleet conditions remained at the same level, 15 percent.

The early years of the 2000s are history, and the memories of those down years are fading. Fleets reported 2006 was "very good," and 2007 is on track to continue as such. Southern Plains, Mid-South, South Atlantic and Pacific regions anticipate 2007 to be an excellent year, and Mountain is looking for it to be "very good."

Work-volume trends also continue strong, although 2006's net of 33 percent fell short of the anticipated net of 42 percent. Instead, in terms of total machine hours, 45 percent of utilities fleets reported more work in 2006 compared to 2006, and 12 percent reported less. This year, 40 percent say work will increase, and 9 percent say it will decrease, leaving a net of 31 percent.

Fleet size, measured in number of machines, grew for 34 percent of fleets and decreased for 6 percent for a net of 28 percent. This number was right on what utility fleet managers forecast last year. Their forecast for 2007 is slightly lower. About 27 percent say they will expand fleet sizes, and 6 percent say they will decrease, for a net of 22 percent.

Managers weren't able to attain their expected rate of replacement in 2006. After replacing 10.5 percent in 2005, managers expected to replace at a rate of 10.7 last year. Instead, the rate was 9.4 percent. Even so, managers forecast that 2007 fleet-replacement rates will fall just shy of 10 percent.

Utility fleets register some of the highest replacement rates of all equipment users included in our Annual Report & Forecast. This may account for the high level of fleet condition. Fifty-four percent of utility fleets report "excellent" or "very good" fleet condition. On the other hand, 6 percent say the fleet is in "fair" or "poor" condition.