Real construction spending after inflation will expand between 2 and 2.5 percent in 2005, a decline from the approximate 4.5-percent gain expected in 2004. Nominal construction spending, including inflation, will fall from an estimated 8.7-percent increase in 2004 to a 4.5-percent gain in 2005.

The spending mix, however, turns favorable this year. Residential spending soared 12.5 percent in 2004, buoyed by persistent cheap mortgage rates and large gains in lumber and steel costs. But it will increase only 0.3 percent in 2005 as mortgage rates rise and cost increases ease.

But spending for nonresidential buildings will increase more quickly in 2005, with an 11.3-percent gain projected following the 4.9 percent in 2004. This will be the first significant gain in inflation-adjusted activity in four years. Also, spending growth for nonbuilding projects will expand from 3.6 to 6.6 percent. This will be the first gain in inflation-adjusted activity in three years.

These trends are expected to continue into 2006 with a further decline in residential activity and further expansion in both nonresidential and heavy-construction activity.

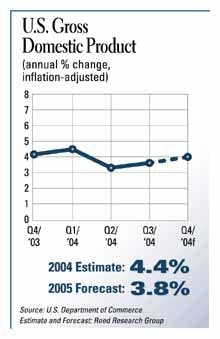

The economic environment for construction will be favorable in 2005 as the economic expansion matures. But the environment will change significantly from 2004. Growth in gross domestic product (GDP) has already slipped from above 5 percent to between 3.5 and 4.0 percent, where it will average through 2005. Credit costs will rise, but only to the average range—not enough to dominate construction-spending trends.

Construction-materials cost inflation will ease to an annual rate between 2.0 and 2.5 percent; this will be slightly more than overall inflation in the economy. This means that most of the sustained price rises experienced in 2004 will hold although the extreme spot prices for panels, framing lumber, and steel will not be repeated.

The labor market will be slightly tighter for contractors as 2.5 million jobs are added across the economy. This includes significant hiring by motor freight carriers and manufacturers, the two key competitors for young male semi-skilled workers. But there is enough slack in the labor market to keep most contractors from having to scramble for help or raise wages to attract workers from other industries. The labor market will tighten further in 2006.

Most important, there will be less excess commercial and industrial space, higher corporate profits, cash balances, and business confidence in the private market and stronger government budget balances in the public market. These are the changes that always spur a surge in nonresidential and heavy projects late in every business cycle.

The strongest regional economies early in 2005 will be the Atlantic and Pacific states with the interior states lagging. This gap will narrow over the year as manufacturing continues to expand. The best metropolitan market opportunities include housing and renovation in the Northeast spurred by the region's high income growth; commercial expansion in the Washington, D.C., area to serve government and technology employers; rebuilding and residential and commercial expansion in Florida's coastal retirement centers; commercial and industrial space in Los Angeles to service expanding Asian trade; and more of everything in California's central valley, Phoenix and Las Vegas where relatively low costs are attracting the most migration, both foreign and domestic.