The residential sector has steadily increased its share of total construction spending during the past several years, as average growth rates for both new home construction and remodeling (about 30 percent of the residential total) have outpaced the averages for both nonresidential building and heavy work. the publicly funded share of overall construction spending has steadily taken a larger share of the pie during the past 5 years as well.

Tables: | |

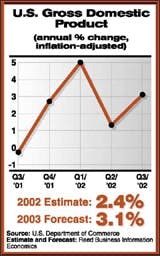

Consumer and business uncertainty was almost palpable at the end of 2002, and 2003's economic outlook depends in part on these changeable attitudes and perspectives. But, if things go right, overall economic growth rates during 2003 will be at least a little bit stronger than during either 2001 or 2002.

Most forecasts assume the following general scenario. War with Iraq commences within the first six weeks of the new year. The quick conclusion and ultimate outcome is apparent by the early spring. Confidence returns to consumer and business markets, prompting an immediate spike in consumer spending, business investment, and the stock market. Then things settle down once again to a more sustainable pace of activity.

For the past two and a half years, however, businesses have been reluctant to invest. The stock market plunge and the depressing impact on corporate profits have provided little money with which to invest in new equipment or buildings.

This state of affairs won't last forever, but there will be a much less robust increase in capital spending during the early and middle stages of this economic recovery. If all turns out better than expected during 2003, we could see a euphoric rally in the stock market, in business investment, and in consumer spirits.

Concerns about jobs, terrorism and a future war with Iraq weighed heavily upon American consumers as 2002 ended. And all of this has made businesses reluctant to invest. A self-reinforcing cycle seems to have been established that has made it almost impossible for the U.S economy to gain any "traction," even a year after the nation's recession came to an end.

For the construction industry, the fluidity and unpredictability of the year ahead means that the direction of the global economy—with special emphasis on U.S. markets—is more important than ever. The combination of plunging business and consumer confidence, higher unemployment, and slow/no growth in household income, can't help but have negative implications for construction end-markets.

But the major positive force—the stimulative impact of low interest rates—will certainly continue to provide significant support for the industry during the year ahead. Although office and industrial vacancy rates have risen steadily throughout 2001 and 2002, they're still reasonably low by historical standards. And a bust on the order of magnitude anywhere near approaching that experienced in the late '80s/early '90s is highly unlikely, since supply of space has been added with great restraint and less speculation over the past decade.

The construction industry entered the recession in reasonably good shape. Although the rest of the economy struggled to keep its head above water throughout 2001 and much of 2002, the construction sector held its own as measured by total dollars spent.

Nevertheless, the forecasts in the accompanying tables show full-year-2002 growth that falls below the third-quarter 2002 trends. In general terms, this is because all objective evidence through September points to economic conditions that will be less favorable over the final three months of this year than over the first three-quarters of 2002.

Nonresidential Construction Trends | $ BillionsAnnual % Change2003200120022003Source: U.S. Commerce Dept.Estimate and Forecast: Reed Business Information EconomicsThe extreme weakness experienced in nonresidential building markets is directly attributable to the depressed overall state of business capital spending. With corporate profits already starting to improve, there will be some money available during 2003 for new construction and/or renovations on existing buildings. The commercial and industrial sectors will benefit from the gradually improving economy, but institutional sector spending will grow more slowly during 2003 than over the past several years because of the severe budget shortfalls at state and municipal governments.Total Nonresidential Spending$286.70.4%-7.3%3.8%Commercial$108.5-4.2%-17.2%3.4%Office$40.4-6.4%-27.1%6.6%Retail$57.0-0.1%-6.6%1.2%Hotel/Motel$11.1-11.5%-25.9%3.7%Industrial$18.2-8.7%-40.8%5.8%Institutional$160.07.2%8.3%3.8%Healthcare$21.83.2%10.6%2.7%Private$16.74.7%9.2%1.2%Public$5.1-2.0%16.0%8.3%Education$84.611.8%13.3%9.1%Private$14.311.0%8.5%4.4%Public$70.311.9%14.4%10.2%Religious$8.83.6%2.2%3.5%Other Private$7.9-10.4%-11.1%-5.0%Other Public$36.97.4%3.7%-4.4%Heavy Construction Trends & Outlook | $ BillionsAnnual % Change2003200120022003Source: U.S. Commerce Dept.Estimate and Forecast: Reed Business Information EconomicsConstraints imposed on public spending because of ballooning federal, state and local budget deficits should have a greater impact on public building construction work than on spending for critical infrastructure needs. Spending on highways, bridges, dams, and water supply systems—some directly related to homeland security priorities—will grow moderately during 2003. But spending for all sorts of privately funded projects—from electric power plants to telecommunications infrastructure to sports stadiums—is headed sharply lower.Total Nonbuilding Spending$154.54.5%-0.6%-0.3%Total Public Nonbuilding$97.56.2%-0.4%2.5%Highways & Streets$54.99.7%-3.3%5.1%Water$7.919.3%3.1%6.8%Sewer$8.9-0.6%7.7%-5.3%Conservation & Development$8.117.5%9.3%3.8%Other Public Nonbuilding$17.7-6.9%-1.2%-3.3%Total Private Nonbuilding$57.01.9%-0.7%-4.7%Telecommunications$14.7-1.4%-15.5%-5.5%Utilities/Other$42.33.5%6.0%-4.2%Construction Spending to Increase 1.6 Percent to $856.2 Billion | $ BillionsAnnual % Change2003200120022003* Improvements Spending (for remodeling, renovation, and retrofit work) included in the total.Source: U.S. Commerce Dept.Estimate and Forecast: Reed Business Information EconomicsOverall construction spending should improve a bit during 2003, but growth will again be uneven. Nonresidential building construction plunged during 2002, as overcapacity in industrial markets and an excess of office and hotel space weighed heavily upon the sector. Following a solid gain in 2001, heavy construction couldn't hold its spending level in 2002 and will likely stagnate in the year ahead. The projected bounce back in the nonresidential market shouldn't be mistaken for a real sign of strength; rather it represents a transitional phase to moderate sustainable growth following two years when the sector couldn't even tread water.Total Construction Spending$856.22.7%-0.1%1.6%Residential New Construction$293.65.6%5.1%-0.2%Residential Improvements$121.4-0.4%7.5%3.%Nonresidential Construction*$286.70.4%-7.3%3.8%Nonbuilding Construction$154.54.5%-0.6%-0.3%Total Private Construction Spending$646.41.3%-1.5%1.0%Total Public Construction Spending$209.87.8%5.0%3.8%