Four very different years have passed since Construction Equipment's 1999 census of the nation's fleet of equipment. Two of those years capped off an amazing decade of construction activity, and the other two ushered in the current economic decline. Census data reflect the effect those two events had on the equipment universe.

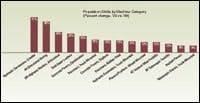

Once again, noted industry research firm MacKay & Co. conducted the Construction Equipment Universe of Construction Equipment survey. As far as raw numbers are concerned, the nation's fleet of construction equipment grew 10 percent in 2003, with 1,429,000 units in operation. Included in that universe are 28 major categories of machines in earthmoving, paving and lifting. At the bottom of this page are the changes in machine counts for each category, and on subsequent pages are detailed analysis for 12 of the most populous and significant machines.

As the fleet grew, so did the number of firms operating the equipment. Rebounding from a dip in 1999, the number of fleets increased to 84,870, up 9.3 percent over 1995. The expansion of the 1990s fueled this growth, especially among building contractors, says John Blodgett, MacKay's sales and marketing manager. The number of mid-sized firms increased, and continued consolidation was evident among firms with fleet replacement values greater than $10 million. Building contractors comprise 37 percent of the firm census, followed by highway/heavy contractors at 34 percent and diversified (both building and highway/heavy) at 10 percent. This 81 percent of the universe, in turn, operates 74 percent of the machines.

The 10-percent expansion of the nation's fleet was fueled by increased popularity and diversity in several categories—notably crawler-mounted hydraulic excavators and skid-steer loaders—as well as the continued growth in new machine types such as directional-boring equipment.

In turn, six of the 28 machine categories have lost machine counts since 1999. Rigid-frame motor graders and rigid-frame off-highway trucks, for example, have fallen off as their articulated siblings gain in popularity.

As these types of changes occurred among machine types, the overall age of the universe grew in many categories. Machine design and engineering has given the industry more durable components, Blodgett says, which contributes to longer life cycles.

This increase in the average age can also be tied to the increase in the number of rental outlets. "These companies bought a lot of new equipment [since the last survey]," he says. "But they also turned it quickly, so they did not have to get too deep into them service-wise. This helped provide a market of fairly new used equipment at very reasonable prices."

This influx of high-quality used equipment has kept steady the percentage of the nation's fleet that is owned—64 percent versus 65 percent in 1999.

The Construction Equipment Universe of Equipment contains detailed analysis of 28 machine types, samples of which are highlighted on the next four pages. For information on how to obtain the full study, contact us at 630/288-8141.

2003 Equipment Census(Number of equipment-operating firms; number of machines in millions)The final years of the economic expansion inspired solid growth in the number of equipment operating firms.

Population: The operating universe has increased to 254,712 machines, up 18 percent since 1995. Relatively low acquisition costs and machine versatility has fueled that growth. Some 38 percent of the machines are rented, with 45 percent purchased new or leased, and 17 percent purchased used.

User firms: Nearly three-quarters of the firms universe, or 64,244, use these machines. Eight in 10 users are contractors, and almost 90 percent operate fleets with replacement values of $5 million or less.

Average age: After dipping in 1999, the average age is back to its 1995 levels of 6.3 years. The availability of units leaving rental fleets has increased the number of machines acquired used.

Lifecycle: The primary lifespan is 10.3 years, when these machines are used an average of 1,600 hours annually. Over the useful life of the machine, about 18 years, average annual usage is 909 hours, down from 958 hours in 1999.

Directional-Boring Equipment + 36%

Population: The telecom boom helped boost the machine count to 11,648. Machines are being used in more applications, too, such as water line installation and repair. The portion acquired new has dropped from 86 percent in 1999 to 67 percent in 2003, with 48 percent purchased and 19 percent leased.

User firms: Utilities represent 16 percent of the 6,150 firms using this machine. About one-quarter of the firms have fleets sized between $5 million and $10 million, and another 23 percent have fleet sizes less than $500,000.

Average age: This category is relatively young, so the average age has increased since 1999, from 2.7 years to 4.0.

Lifecycle: The useful age has increased to 9.6 years since 1999, with an average annual utilization of 811 hours. The primary lifespan is 4.7 years, which is less than any other type of equipment. This may be due to the machine's rapidly developing technology.

Hydraulic Excavators, Crawler + 41%

Population: Continued growth in the small-excavator segment has fueled the jump to 156,535 machines. One in 10 has an operating weight less than 12,000 pounds; in 1995, 9 percent were less than 20,000 pounds. Nearly 70 percent of the universe is owned, and 16 percent rented. More then half of the universe is acquired as new product, either leased or purchased.

User firms: The number of firms using crawler excavators has jumped 10 percent since 1995 to 44,024.

Average age: This has remained at 6.1 years for the past eight years.

Lifecycle: The primary lifespan for this machine is 8.6 years, although the average age for trading is 6.7 years. The useful life of these machines is 17 years. Average utilization is virtually the same as in 1999 at 1,194 hours.

Motor Graders, Articulated + 6%

Population: The number of articulated graders stands at 48,276--up 23 percent from 1995. Rigid-frame machines have dropped 47 percent in the same time period. Today, 14 percent of articulated graders are rented, but 71 percent are owned. Almost half are purchased new; 16 percent are purchased used.

User firms: The number of firms using this machine has grown 19 percent since 1999 to 18,394. Highway/heavy contractors recorded the largest jump, with 10,251 firms using these machines in 2003, up from 8,430 in 1999.

Average age: These machines average 7.5 years old, a slight increase over 1999.

Lifecycle: Primary lifespan for these machines is 12 years; they are traded, on average, at 14.2 years. The useful life is 22 years, with an average annual usage of 1,008 hours.

Off-Highway Haulers, Articulated + 24%

Population: This category has increased 72 percent since 1995 and to-day has 7,254 in the universe. The articulated models are replacing older rigid-frame units. In addition, some rental firms have added these machines to their fleets. Some 85 percent of the machines are owned, however, and 37 percent are leased machines.

User firms: The number of firms has also jumped since 1995, by 37 percent, to a current total of 2,459 firms. Eighty-three percent of these firms are contractors, mostly high-way/heavy.

Average age: Average age has increased over the past eight years full year has been added to average age since 1995. 5.8 years.???????????

Lifecycle: Primary lifespan and trade cycles have increased since 1999, to 6.6 years and 7.4 years, respectively. The useful life of these machines is also longer, increasing to 13 years from 11.6 years in 1999. Average annual usage is 1,358 hours, with nearly 1,800 hours registered in the first year.

Population: Increasing numbers of large models plus an explosion of attachments have helped boost numbers to 281,728 for this machine; 13 percent are more than 2,701 pounds. One-third are rented, and a growing percentage are purchased used as rental machines work into the used market.

User firms: The number of firms has increased 4 percent to 56,627 and excludes non-construction users such as farms, golf courses and landscape contractors. Sixty-seven percent of these firms have fleets less than $5 million in replacement value; 31 percent are $500,000 or less.

Average age: The average age has been rising steadily since 1991, but in 2003 dropped a bit to 5.2.

Lifecycle: Primary lifespan is 8.1 years, and the average machine is traded in at 8.5 years. The useful life of these machines is 13.2 years, with average utilization of 834 hours a year.

Population: The number of machines totaled 63,896 in 2003. The percentage of machines acquired new decreased from 70 percent in 1999 to just more than 50 percent in 2003. Some 28 percent of owned machines are purchased used.

User firms: The number of firms with these machines increased 7 percent since 1995, to 15,972. Utilities firms increased the most, from 1,595 to 1,950. Forty percent of the firms are highway/heavy contractors.

Average age: Age continues to steadily increase to 6.9 years, up nearly a year from 1995.

Lifecycle: Primary lifespan is 9.8 years. They are scrapped at 13 years, up 1.5 years from 1999. Average annual usage is 620 hours, down from 644, with first-year utilization averaging 900 hours.

Population: The number of machines has increased 20 percent since 1995 to 176,748 units. The number of rental units declined slightly. Size segmentation has shifted since 1999, when 59 percent had a bucket capacity of 3.5 yards or less; now 47 percent are in that range. The growth occurred in the 3.6- to 5-yard range.

User firms: A little more than half of the universe own wheel loaders, or 45,086 firms. This is down from 1999, when it was 55 percent. There are 26 percent more utility firms using loaders; 29 percent fewer mining firms.

Average age: The average age of 8.7 years has remained constant for the past eight years, although it is up slightly from 8.4 in 1999.

Lifecycle: Primary lifespan is 8.1 years, but the average is traded at 6.4 years. The useful life of these machines is 21 years, with average annual usage of 1,295 hours. Average utilization is down 4 percent from 1,348 in 1999.

Population: The growth in number of machines has far outpaced the growth in firms, with 15,971 in the universe. On average, for every additional user, two machines entered service. Although 70 percent are still purchased new, the number of rental machines crept up to 10 percent from 8 percent in 1999.

User firms: Some 5,572 firms use these machines, up 12 percent from 1999. All fleet sizes increased usage except the largest, $10 million or more in replacement value.

Average age: The average has dropped over the past eight years, from 8.5 years in 1995 and 8.3 years in 1999 to the current 7.8 years. Operators seem to be using them more intensely, generating faster paver disposal cycles.

Lifecycle: Primary lifespan is 9.9 years. Useful life decreased two years since 1999 from 19.6 years to nearly 17.5 years. Annual usage rate is 936 hours, down from 1,012.

Population: Of the 4,665 pavers in the universe, 72 percent are capable of laying a slab of 12 feet or more in width. An increasing number are being rented, now estimated at 18 percent, and more are being purchased used, too.

User firms: Growing 6 percent since 1999, 2,695 firms operate these machines. Nearly all are contractor firms (97 percent) and they own an average of 1.7 units. Two-thirds are owned by firms with fleet-replacement values of less than $5 million.

Average age: The average of 7.1 years is up from 6.6 in 1995.

Lifecycle: Primary lifespan is 10.8 years, but the trade cycle has expanded from 8.3 years to 10.2. Scrap-page practices have also extended with the average increasing from 14 years to 17.3. Average annual usage is 598 hours, declining to 200 hours at point of scrappage.

Rough-Terrain Forklifts, Telescopic +10%

Population: Totaling 31,096 units, this category has grown 55 percent since 1995. Nearly 40 percent are rented, with only 33 percent owned and 28 percent leased. Of the owned equipment, 15 percent was purchased new and 18 percent used.

User firms: Since 1999, the number of firms has increased 14 percent to 14,138. Eighty-six percent of these firms are contractors; 75 percent are firms will fleets less than $5 million in replacement value, up from 70 percent in 1999.

Average age: The average has declined to 6.5 years as new units have entered the universe due to a strong rental demand.

Lifecycle: Primary lifespan is 10.7 years, up 0.6 years. Trade cycles also expanded, up 1.2 years to 8.1. Useful life, however, has shorted from 15.5 years to 14. Average annual hours of use is down slightly from 1999 to about 1,095 hours.

Rough-Terrain Forklifts, Vertical Mast +12%

Population: Since 1995, the universe has expanded 45 percent to 29,979 units. About 40 percent are owned outright, and 39 percent are rented with the rest leased. About 20 percent were purchased new; another 20 percent were purchased used.

User firms: The number of firms has increased 11 percent to 15,705. Eight in 10 firms are contractors, and nearly two-thirds are building contractors. About 75 percent of the firms using these machines have fleets valued at less than $5 million.

Average age: The average of 8.5 years has stayed nearly unchanged over the past 8 years.

Lifecycle: Primary lifespan for these machines is 12 years; they are traded, on average, at 14.2 years. The useful life is 22 years, with an average annual usage of 1,008 hours.

Off-Highway Haulers, Articulated + 24%

Population: This category has increased 72 percent since 1995 and to-day has 7,254 in the universe. The articulated models are replacing older rigid-frame units. In addition, some rental firms have added these machines to their fleets. Some 85 percent of the machines are owned, however, and 37 percent are leased machines.

User firms: The number of firms has also jumped since 1995, by 37 percent, to a current total of 2,459 firms. Eighty-three percent of these firms are contractors, mostly high-way/heavy.

Average age: Average age has increased over the past eight years full year has been added to average age since 1995. 5.8 years.???????????

Lifecycle: Primary lifespan and trade cycles have increased since 1999, to 6.6 years and 7.4 years, respectively. The useful life of these machines is also longer, increasing to 13 years from 11.6 years in 1999. Average annual usage is 1,358 hours, with nearly 1,800 hours registered in the first year.

Skid-Steer Loaders + 22%

Population: Increasing numbers of large models plus an explosion of attachments have helped boost numbers to 281,728 for this machine; 13 percent are more than 2,701 pounds. One-third are rented, and a growing percentage are purchased used as rental machines work into the used market.

User firms: The number of firms has increased 4 percent to 56,627 and excludes non-construction users such as farms, golf courses and landscape contractors. Sixty-seven percent of these firms have fleets less than $5 million in replacement value; 31 percent are $500,000 or less.

Average age: The average age has been rising steadily since 1991, but in 2003 dropped a bit to 5.2.

Lifecycle: Primary lifespan is 8.1 years, and the average machine is traded in at 8.5 years. The useful life of these machines is 13.2 years, with average utilization of 834 hours a year.

Trenchers, Rubber-Tired +14%

Population: The number of machines totaled 63,896 in 2003. The percentage of machines acquired new decreased from 70 percent in 1999 to just more than 50 percent in 2003. Some 28 percent of owned machines are purchased used.

User firms: The number of firms with these machines increased 7 percent since 1995, to 15,972. Utilities firms increased the most, from 1,595 to 1,950. Forty percent of the firms are highway/heavy contractors.

Average age: Age continues to steadily increase to 6.9 years, up nearly a year from 1995.

Lifecycle: Primary lifespan is 9.8 years. They are scrapped at 13 years, up 1.5 years from 1999. Average annual usage is 620 hours, down from 644, with first-year utilization averaging 900 hours.

Wheel Loaders +5%

Population: The number of machines has increased 20 percent since 1995 to 176,748 units. The number of rental units declined slightly. Size segmentation has shifted since 1999, when 59 percent had a bucket capacity of 3.5 yards or less; now 47 percent are in that range. The growth occurred in the 3.6- to 5-yard range.

User firms: A little more than half of the universe own wheel loaders, or 45,086 firms. This is down from 1999, when it was 55 percent. There are 26 percent more utility firms using loaders; 29 percent fewer mining firms.

Average age: The average age of 8.7 years has remained constant for the past eight years, although it is up slightly from 8.4 in 1999.

Lifecycle: Primary lifespan is 8.1 years, but the average is traded at 6.4 years. The useful life of these machines is 21 years, with average annual usage of 1,295 hours. Average utilization is down 4 percent from 1,348 in 1999.

Asphalt Pavers +8%

Population: The growth in number of machines has far outpaced the growth in firms, with 15,971 in the universe. On average, for every additional user, two machines entered service. Although 70 percent are still purchased new, the number of rental machines crept up to 10 percent from 8 percent in 1999.

User firms: Some 5,572 firms use these machines, up 12 percent from 1999. All fleet sizes increased usage except the largest, $10 million or more in replacement value.

Average age: The average has dropped over the past eight years, from 8.5 years in 1995 and 8.3 years in 1999 to the current 7.8 years. Operators seem to be using them more intensely, generating faster paver disposal cycles.

Lifecycle: Primary lifespan is 9.9 years. Useful life decreased two years since 1999 from 19.6 years to nearly 17.5 years. Annual usage rate is 936 hours, down from 1,012.

Concrete Pavers, Slab +4%

Population: Of the 4,665 pavers in the universe, 72 percent are capable of laying a slab of 12 feet or more in width. An increasing number are being rented, now estimated at 18 percent, and more are being purchased used, too.

User firms: Growing 6 percent since 1999, 2,695 firms operate these machines. Nearly all are contractor firms (97 percent) and they own an average of 1.7 units. Two-thirds are owned by firms with fleet-replacement values of less than $5 million.

Average age: The average of 7.1 years is up from 6.6 in 1995.

Lifecycle: Primary lifespan is 10.8 years, but the trade cycle has expanded from 8.3 years to 10.2. Scrap-page practices have also extended with the average increasing from 14 years to 17.3. Average annual usage is 598 hours, declining to 200 hours at point of scrappage.

Rough-Terrain Forklifts, Telescopic +10%

Population: Totaling 31,096 units, this category has grown 55 percent since 1995. Nearly 40 percent are rented, with only 33 percent owned and 28 percent leased. Of the owned equipment, 15 percent was purchased new and 18 percent used.

User firms: Since 1999, the number of firms has increased 14 percent to 14,138. Eighty-six percent of these firms are contractors; 75 percent are firms will fleets less than $5 million in replacement value, up from 70 percent in 1999.

Average age: The average has declined to 6.5 years as new units have entered the universe due to a strong rental demand.

Lifecycle: Primary lifespan is 10.7 years, up 0.6 years. Trade cycles also expanded, up 1.2 years to 8.1. Useful life, however, has shorted from 15.5 years to 14. Average annual hours of use is down slightly from 1999 to about 1,095 hours.

Rough-Terrain Forklifts, Vertical Mast +12%

Population: Since 1995, the universe has expanded 45 percent to 29,979 units. About 40 percent are owned outright, and 39 percent are rented with the rest leased. About 20 percent were purchased new; another 20 percent were purchased used.

User firms: The number of firms has increased 11 percent to 15,705. Eight in 10 firms are contractors, and nearly two-thirds are building contractors. About 75 percent of the firms using these machines have fleets valued at less than $5 million.

Average age: The average of 8.5 years has stayed nearly unchanged over the past 8 years.

Lifecycle: Primary lifespan is 11.8 years, with the average machine traded at 10.1 years. This is up 1.5 years and 1.8 years, respectively. These machines are usually scrapped at 17.2 years, 1.3 years earlier than in 1999. Annually, machines rack up an estimated average of 1,152 hours.

Four very different years have passed since Construction Equipment's 1999 census of the nation's fleet of equipment. Two of those years capped off an amazing decade of construction activity, and the other two ushered in the current economic decline. Census data reflect the effect those two events had on the equipment universe.

Once again, noted industry research firm MacKay & Co. conducted the Construction Equipment Universe of Construction Equipment survey. As far as raw numbers are concerned, the nation's fleet of construction equipment grew 10 percent in 2003, with 1,429,000 units in operation. Included in that universe are 28 major categories of machines in earthmoving, paving and lifting. At the bottom of this page are the changes in machine counts for each category, and on subsequent pages are detailed analyses for 12 of the most populous and significant machines.

As the fleet grew, so did the number of firms operating the equipment. Rebounding from a dip in 1999, the number of fleets increased to 84,870, up 9.3 percent over 1995. The expansion of the 1990s fueled this growth, especially among building contractors, says John Blodgett, MacKay's sales and marketing manager. The number of mid-sized firms increased, and continued consolidation was evident among firms with fleet replacement values greater than $10 million. Building contractors comprise 37 percent of the firm census, followed by highway/heavy contractors at 34 percent and diversified (both building and highway/heavy) at 10 percent. This 81 percent of the universe, in turn, operates 74 percent of the machines.

The 10-percent expansion of the nation's fleet was fueled by increased popularity and diversity in several categories—notably crawler-mounted hydraulic excavators and skid-steer loaders—as well as the continued growth in new machine types such as directional-boring equipment.

In turn, six of the 28 machine categories have lost machine counts since 1999. Rigid-frame motor graders and rigid-frame off-highway trucks, for example, have fallen off as their articulated siblings gain in popularity.

As these types of changes occurred among machine types, the overall age of the universe grew in many categories. Machine design and engineering has given the industry more durable components, Blodgett says, which contributes to longer life cycles.

This increase in the average age can also be tied to the increase in the number of rental outlets. "These companies bought a lot of new equipment [since the last survey]," he says. "But they also turned it quickly, so they did not have to get too deep into them service-wise. This helped provide a market of fairly new used equipment at very reasonable prices."

This influx of high-quality used equipment has kept steady the percentage of the nation's fleet that is owned—64 percent versus 65 percent in 1999.

The Construction Equipment Universe of Equipment contains detailed analysis of 28 machine types, samples of which are highlighted on the next four pages. For information on how to obtain the full study, contact us 630/288-xxxx or by e-mail at [email protected].