“As a result of the past economic environment, service-truck buyers tend to procrastinate, so a necessary discipline in our business today is to be more responsive, more agile—prepared to meet customer needs when they’re ready to buy.”—Craig Bonham, vice president of sales, Reading Truck Body.

Along with reacting quickly to customer needs, which for some manufacturers has meant developing new manufacturing techniques that speed the delivery process, builders of service/mechanics trucks are continuing to refine their products by doing what they have always done well—listening to customers and then crafting vehicles to address the needs voiced. Construction Equipment recently asked manufacturers what they’re hearing from buyers these days.

Sean Moran, Stellar Industries:

• “Maximizing the truck’s payload capability has become very important. To do this, we must reduce the original vehicle weight to best utilize the truck’s space and capabilities. Some customers try switching to a lower-GVW truck, but we caution that doing so may limit what operators can take with them to the job site—which may limit overall productivity.”

Dennis Seyller, Seyller Original Bodies:

• “Seems to be a move away from PTO-driven equipment to self-contained power units, because of more stringent emission standards and concerns about fuel consumption.”

• “We’re seeing a shift to more custom bodies due to the increasing popularity of the alternate-fuel chassis.”

Kris Cleveland, Auto Crane:

• “Buyers are looking for a robust, durable body and a crane that adds value. Some customers try to get more than one chassis out of body and crane, while others auction off service vehicles at a specific mileage or time interval and want high resale value. In either instance, durability is a critical issue.”

Terry Cook, Iowa Mold Tooling (IMT):

• “We’re seeing a move toward the use of fully integrated power units to provide an air compressor, auxiliary electrical power, and a welder—instead of a PTO and hydraulic pump—to manage fuel consumption, reduce environmental impact, and lower chassis-maintenance costs.”

• “Payload improvement is an increasing concern. With exhaust after-treatment requirements, chassis weight has increased, and manufacturers are pressured to control the truck’s package weight to preserve precious payload capacity—along with improving the crane’s lift-to-weight ratio and enhancing safety/stability features.”

Walt Van Laren, Service Trucks International (STI):

• “Controlling the unit’s weight—body, crane, chassis—and increasing available payload continue to become more important for buyers.”

• “Class 5 and smaller chassis have just about entirely moved to automatic transmissions, and we’ve seen a significant shift in preference for automatics in Class 6 and larger.”

• “Adding lube equipment continues to grow.”

Joe Halprin, Stahl:

• “With the increase in domestic oil and gas drilling/production, we’re seeing an increase in demand for service vehicles with cranes, primarily with Class 3 to 5 chassis.”

Mike Butsch, Stellar Industries:

• “Buyers are spec’ing to get full potential from the vehicle, while also keeping maximum resale value in mind. Manufacturers have to design the package—body, crane, and control system—for application flexibility. In addition, safety continues to be a critical factor—rear- and side-mounted cameras, back-up sensors, and crane-safety sensors are important features and options these days.”

Jim Brown, Omaha Standard Palfinger:

• “Increasing payload is a key factor in today’s market, as is improved corrosion protection. Fleets today are focused on lowering operating costs.”

Tim Davison, Stellar Industries:

• “Operators want [service-truck designs] that maximize their equipment and their time to improve efficiency and productivity—which means optimum up-time for their customers. An aspect of that is a crane-management system that keeps the operator informed about crane functions with easily accessible, real-time information.”

Craig Bonham, Reading Truck Body:

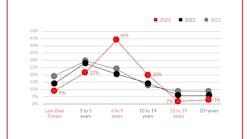

• “We’re seeing the average time a truck is in service rise from three to five years, to six to 10 years. The user’s expectation is that the truck needs to last that long and still look good. Corrosion-resistance is all the more important; the use of aluminum is increasing, but aluminum must be engineered for the application to ensure structural integrity.”

• “Safety and ergonomics are increasing concerns. Buyers want designs that are easy on the operator and minimize exposure to safety-related incidents.”

• “Some buyers planning to use compressed natural gas as an alternate fuel are ordering trucks with longer wheelbases to accommodate tank receptacles without giving up storage capacity. Buyers must keep in mind, however, that such designs could cause maneuverability issues in urban areas.”

Matt Collins, Auto Crane:

• “We see an uptick in ‘all-in-one’ power systems that have a stand-alone hydraulic system that eliminates the PTO for running the crane—especially among buyers who keep service-crane trucks for a longer time and can justify the added cost.”

• “Buyers are continually looking at ways to increase payload, but there’s a fine line between increasing payload and increasing costs. Buyers need to evaluate how much added payload and lift capacity are worth.”