Many of the remodelers we speak to regularly defined 2013 as a “good” or “very good” year for their business. Coming off an inconsistent 2012, their profit margins increased slightly in 2013 due to an improving housing market, rising home prices, lower interest rates, easier financing, positive consumer sentiment, and a series of natural disasters that impacted pockets of the country.

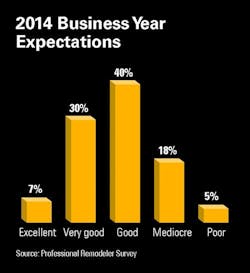

Continuing to build on momentum gained in 2013, 71 percent of the remodelers who responded to our survey expect an increase in their revenue for 2014. Nineteen percent of remodelers expect no change to their revenue in 2014, and 10 percent expect their revenue to decrease when compared with 2013.

More Annual Report & Forecast

“In the near term, homeowner spending on improvements is expected to see its strongest growth since the height of the housing boom,” says Kermit Baker, director of the Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University. “Existing-home sales are still growing at a double-digit pace, and rising house prices are helping homeowners rebuild equity lost during the housing crash.”

Remodelers echo Baker’s predictions about the 2013 remodeling market momentum carrying into at least the early months of 2014.

“I believe 2014 will continue the same strong growth we have seen in 2013. Average remodeling project size in terms of dollars will increase as clients choose larger projects and focus on higher-quality materials and craftsmanship,” says Jason Parsons, remodeling project designer, Design Build Pros, Toms River, N.J.

Some 71 percent of respondents had expected revenue to increase in 2013, 11 percent expected their revenue to decrease, and 18 percent expected no change in their 2013 revenue when compared with 2012. Actual 2013 revenue increased for 64 percent of remodelers responding, 20 percent reported their revenue had decreased, and 16 percent reported no change in revenue compared with 2012. Despite the slight decrease from their 2013 projections compared to the 2013 actual results, remodelers remain optimistic for 2014.

“We already have jobs signed for 2014 and feel our 2014 should be better than 2013,” says Scott Sevon, partner, MAW Chicago, Palatine, Ill.

Will home improvement taper?

The Joint Center’s Leading Indicator of Remodeling Activity (LIRA) report in the fall of 2013 found the home remodeling market continues to improve, with strong gains expected at the close of 2013 and positive momentum carrying into the early part of 2014. Even though the LIRA continues to project annual improvement spending to increase at a double-digit pace in the near term, remodelers should be cautious as the LIRA projects a slowdown of this growth in the middle of 2014.

“The soft patch that homebuilding has seen in recent months, coupled with rising financing costs, is expected to be reflected in slower growth in home-improvement spending beginning around the middle of next year,” says Eric S. Belsky, managing director of the Joint Center. “However, even with this projected tapering, remodeling activity should remain at healthy levels.”

Some remodelers who responded to our survey concur with the LIRA projection for early 2014.

“We feel 2014 will be a good year for continued upward growth in both volume and bottom line. We are cautious not to be overly optimistic due to the ever-changing economic climate out there,” says Sal Ferro, president and CEO, Alure Home Improvements, Plainview, N.Y.

“2014 sales may be at a slower rate of increase than last year,” says Bob Hanbury, president, House of Hanbury, Newington, Conn.

Meanwhile, lead activity for 2014 is expected to increase over 2013 even though 33 percent of remodelers indicated their 2014 lead activity will remain unchanged compared with 2013. Just over 40 percent of remodelers indicated they expect leads to increase over 2013 compared with 24 percent who expect leads to decrease.

“2014 will look a lot like 2013, and activity will remain constant or slightly up,” says Andy Wells, principal, Normandy Design Build Remodeling, Hinsdale, Ill.

“I have a very positive outlook for 2014, especially in those areas that went into the recession first. Everyone I have talked to is busy with new leads and new work,” says William Shaw, president, William Shaw & Associates, Houston, Texas.

Concurrent with the expected increase in revenue and leads predicted for 2014, remodelers anticipate the size of the average job to continue to grow as well.

Fifty-six percent of remodelers expect larger jobs and 11 percent expect smaller jobs in 2014. The remaining 33 percent of remodelers indicated the average job size would remain about the same as 2013. Thirty-five percent of remodelers expect the average job size to increase less than 10 percent in 2014 compared with 2013.

Despite these upward-pointing factors, remodelers remain hesitant to add more employees. Only 34 percent of remodelers plan to add to their staff next year, while 6 percent indicated they would be reducing employees. The remaining 60 percent indicated they would not change their current staffing levels for 2014.

Much like 2013, only 2 percent of remodelers plan to cut prices in 2014 as remodelers continue to heavily protect their margins. Fifty-eight percent of remodelers are increasing their 2014 prices, and 40 percent responded they are keeping their prices the same next year.

What are the biggest challenges remodelers expect to face in 2014? Approximately 30 percent indicated the overall economy would remain the biggest challenge followed by finding qualified employees (17 percent) and competition from other remodelers (17 percent). Managing cash, which ranked as one of the top four challenges in 2013, dropped to bottom of this year’s survey after garnering only 5 percent of the response. As for specific opportunities in 2014, new clients accounted for 23 percent of the responses and growing the current client base ranked second with 19 percent, followed by continued work with clients for life (17 percent).