We work in a very capital-intensive business with razor-thin margins. Ever wondered how it works? Ever wondered whether it was more important to make a profit than to reduce the amount of capital required to accomplish the job?

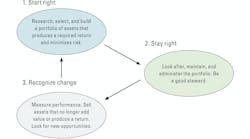

As with most things, it is a balance. As with most things, success requires excellence in more than one dimension. It is not enough to be profitable; we must also manage capital employed and ensure that it is used as efficiently as possible.

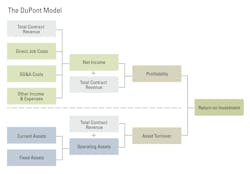

The DuPont model was developed more than a century ago to show how profitability and asset turnover combine to calculate return on investment—one of the most fundamental measures of company performance. The model is as relevant today as it was then, and much can be achieved by understanding how it works and learning what equipment managers can do to improve their company’s performance.

Many variations of the DuPont model are found in practice. Some are more complex than others, and most are heavy in accounting and finance terminology. The diagram at top simplifies the model and illustrates the principles involved using as much construction language as possible. Let’s go through it step by step.

First consider the green boxes above the dotted line. These are straightforward and come from a standard profit and loss statement with profitability defined as net income divided by total contract revenue. Equipment managers are involved in and influence all four of the boxes on the left. First, they affect total contract revenue by providing equipment with the reliability and availability needed to build the required work on time and on budget. Second, they reduce direct job costs by doing the right thing at the right time and eliminating waste. Third, they run their operations as efficiently as possible with minimum overhead and help reduce Selling, General, and Administrative costs (SG&A). Fourth, they look after the fleet to maximize the other income earned when old equipment is sold for more than its book value.

There certainly are many other factors that contribute to company profitability, but we can never underestimate the impact that a well-run equipment operation can, and does, have on bottom line profitability. Equipment management impacts every box, and it is difficult to imagine how company performance can exceed the performance of the equipment used to build the work. Margins are razor thin, and in many cases 5 percent of contract revenue is seen as a reasonable value for bottom-line profitability.

The blue boxes below the dotted line form the second part of the DuPont model. They look a lot like the asset side of the balance sheet, and in many ways, that is exactly what they are. The first box measures the current assets: cash, accounts receivable, retainage, and inventory. The second box measures the fixed assets: property, equipment, vehicles, and other capitalized items. Current assets and fixed assets total to form the operating assets: the financial resources used by the company to generate contract revenue. Some versions of the DuPont model add longer-term strategic assets such as property investments and quarry reserves. But if you are not primarily in the property development or quarrying business, then these have no place in the definition of operating assets.

The key ratio and measure of capital efficiency is asset turnover: how much contract revenue (the output) you earned per dollar of operating assets (the input). If you earned $50 million in contract revenue in a year and used $20 million in operating assets to do this, then the asset turnover is 2.5. This is a lot better than an asset turnover of 2.0 arising from generating the same contract revenue using $25 million of operating assets.

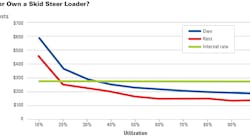

The question is: What can the equipment manager do to reduce the value of operating assets used to earn contract revenue? The list is almost endless. It starts with having the right iron in the fleet and not having capital tied up in machines that keep the yard fence warm. Deployment, availability, and utilization are the key metrics; huge gains can be made in this area. Next comes the buy, borrow, lease, and rent decision. There is no need to own everything and prudent use of “other people’s money” in carefully structured rental or lease agreements can reduce the value of operating assets and improve asset turnover. Bottom line, you absolutely must seek every possible way to move more dirt or lay more pavement for every dollar invested in the fleet.

Return on investment is the product of profitability and asset turnover. The former measures the profitable use of your assets, the latter measures the efficient use of your assets. Both are critical for success. If profitability is 5 percent and asset turnover is 2.5, then return on investment is 12.5 percent. That is a lot better than a return on investment of 10 percent arising from the same 5 percent profitability with an asset turnover of only 2.0.

Different styles or different approaches to fleet replacement and financing affect profitability and asset turnover differently. An old fleet may have higher operating costs but be less capital-intensive and therefore have a good asset turnover number. A young fleet is exactly the opposite. A company that rents or leases a lot of its fleet will have higher owning costs because they pay for the use of other people’s money. But they will own fewer fixed assets and most likely a higher value for asset turnover. As we have seen many times before, there are no right answers, only intelligent decisions.

Also, different lines of business have different requirements for fixed assets and must therefore operate at different levels of profitability to produce the kind of return on investment that encourages investors and facilitates growth in the business. Equipment-intensive companies find it hard to achieve an asset turnover much in excess of 2.2. They must therefore be a lot more profitable than building or general contracting businesses, which have high asset turnovers and low profitability to achieve the same level of return on investment. We know, we understand, and we love our heavy iron. But business is business and we cannot afford to keep it if it cannot be operated profitably and if it cannot be used sufficiently to justify the investment.

Focusing on profitability is, of course, important. But the DuPont model tells us that efficiency in the use of our capital is equally important. Many companies know what it costs to own and operate their fleet with a reasonable degree of accuracy. Few, if any, routinely measure how much contract revenue is earned for every dollar they have invested in their equipment and their on-highway fleet. It is a capital-intensive business with razor-thin margins. We need to implement the concepts DuPont taught us more than a century ago.

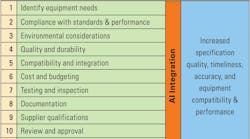

For more on asset management, visit ConstructionEquipment.com/Institute.