Nonconstruction firms outperformed expectations in 2005 and will carry forward these levels into 2006. Utilities and mining and energy fleets show the strongest performance, returning to the high levels of business not seen for several years.

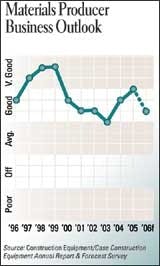

A consistent, though gentle, slope upward marks materials producers' business over the past few years. Last year was the highest mark since the recession, but it appears from the 2006 forecast that these equipment users will stay in the "good" business zone.

Most regions outperformed expectations last year, with bright spots in the South Atlantic and Mountain regions with "excellent" reports. Those two regions lead expectations for 2006, too, joined by the Southern Plains and Pacific regions in anticipating a "very good" year. Mid-Atlantic and Northern Plains expect "average" business in 2006.

Contract volume is expected to drop off this year after missing expectations for last year. In 2005, the percent expecting increases outweighed decreases by a net of 33 percent; the actual net for 2005 was 25 percent (44 percent citing increases in volume minus 19 reporting decreases). Again, Mountain, Southern Plains, and South Atlantic outperformed the average. For 2006, 36 percent of materials producers expect volume growth and 20 percent expect volume decline for a net of 16 percent.

For the second straight year, fleet growth has returned strong, posting the highest net this year since 1999. Four of every 10 fleets increased the number of machines in their fleets, and 3 percent decreased for a net of 37 percent. Expectation for 2006 is for growth, with a net of 23 percent (25 percent increasing minus 2 percent decreasing).

Replacement rates, though, fell short of forecast in 2005 and below the 8- and 9-percent levels in 2003 and 2004. After reporting a replacement rate of 7.7 percent last year, materials producers expect to replace 7.9 percent of their fleet this year.

Fleet conditions improved last year, with 47 percent calling themselves in "excellent" or "very good" shape, up from 40 percent in 2004. Still, 14 percent of materials-producing fleets are in "fair" or "poor" condition.

For the second consecutive year, business reports outshone expectations for mining and energy fleets. In fact, the "very good" of 2005 was the best report in 10 years for this industry. Expectations are slightly higher for 2006.

Great Lakes and Mid-South regions reported an "excellent" business year last year, and the Mid-South expects this year to be similar, joined by New England, Southern Plains, and South Atlantic regions.

Last year was also the best in 10 years for work volume, measured in total machine hours. In fact, the 2005 net (percent increasing volume minus percent decreasing) doubled the forecast made at the end of 2004. Some 53 percent saw increases, 10 percent saw decreases, producing a net of 43 percent. This year, 49 percent expect work volume to increase and only 3 percent expect it to decrease for a net of 46 percent.

To handle the increase in machine hours, 47 percent of fleets expanded (measured in number of machines). Subtract the 8 percent who decreased fleet size, and growth of mining and energy fleets shows a net of 39 percent. This, too, is the strongest fleet expansion in 10 years, and this year promises to continue that trend with a predicted net of 42 percent. Strong growth is expected in the South Atlantic and Mid-South.

On the other hand, fleet replacement rates fell short of expectations. Late in 2004, mining and energy fleet managers forecast a 2005 fleet-replacement rate of 9.6 percent. In actuality, that rate was only 7.6 percent last year. But fleet managers hope to replace fleet more aggressively this year, reporting an expected rate of 8.9 percent for 2006.

Even so, fleet condition is "excellent" or "very good" for 45 percent of mining and energy fleets, about the same as a year ago. On the other side, 14 percent of mining and energy fleets are reported to be in "fair" or "poor" condition.

Utilities returned to business levels of their heydays in the late 1990s, recording a "very good" 2005 after three years of "good" business. These fleets expect 2006 to be more of the same.

Mid-Atlantic region reported an "excellent" 2005, whereas New England and Great Lakes regions lagged with a "good" year. For 2006, South Atlantic expects "excellent," but Great Lakes predicts another "good" year.

Work-volume increases (by machine hours) were the highest since 1999, and expectations for 2006 are the highest recorded since 2000. Last year, 51 percent of utilities fleets reported increased volume. When the 8 percent that reported decreased volume are subtracted, a net of 43 percent remains. This year, the net 42 percent for volume increases (47 percent increases minus 5 percent decreases).

Fleet expansion also returned to 2001 levels. One-third of utilities managers reported expanding their fleets in 2005, and 8 reported decreasing fleet size (in numbers of machines) for a net of 25 percent. Expectations for 2006 leave a similar net of 26 percent (29 percent expanding minus 3 percent shrinking fleet size).

As expansions grow, replacement rates are also edging up. In fact, the rate reported for 2005 was far beyond the rate utilities fleets expected to replace when making the forecast in 2004. The forecast was 8.5 percent, and the actual rate reported last year was 10.5 percent. This appears to be no aberration, as expectations for 2006 call for a similar replacement rate of 10.7 percent.

These expansion numbers and replacement rates may explain why utilities managers report high levels of quality in fleet condition. Some 52 percent say their fleets are in "excellent" or "very good" condition; only 5 percent report "fair" or "poor" fleets.