Owning costs make up between 25 and 30 percent of the total cost of owning and operating a fleet. It is a big portion and, fortunately, a manageable portion. Most of the costs are defined when you ink the deal, and most of the money is spent up front when you take possession of the asset and put it to work. There are not a lot of uncertainties, but there are a lot of complexities, so careful analysis will pay big dividends.

Owning costs have to do with finance, accounting, interest, depreciation and tax. They have little to do with the parts, labor and consumables required to repair and maintain the machine. The skill required to manage owning costs is therefore very different from that required to manage operating costs. Successful managers recognize the differences and manage each with the skill, care and attention it deserves.

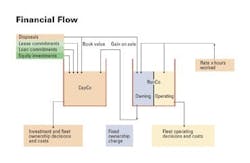

The specialized nature of owning costs causes many companies to establish two separate and distinct responsibility centers for fleet management. The first is responsible for all investment and fleet ownership decisions and costs, while the second is responsible for all operating decisions and costs. The entities can be separate accounts within the overall company or, as is increasingly the case, set up as separate corporations with similar or slightly different ownership structures.

The diagram above shows how it works and how costs and charges flow between the entity responsible for investment decisions and costs—we’ll call it CapCo—and the entity responsible for the operating decisions and costs, RunCo. Clearly, one CapCo can centralize all the investment and ownership decisions for several and, if necessary, very different RunCos.

For more on asset management, click here.

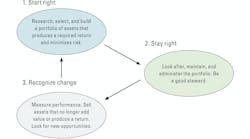

CapCo starts the process off by acquiring the equipment needed to support operations and achieve the organization’s long-term goals. This is not a trivial exercise: Capital is a scarce resource, and construction, quarrying, and materials production are capital-intensive businesses. CapCo can raise capital in three basic ways.

First, it can retain earnings or make new equity investments in the company and then use these cash resources to purchase equipment. Second, it can enter into loan agreements and finance equipment using debt. Third, it can enter into lease agreements and leasing equipment from an outside organization.

All three methods impact the balance sheet differently and each has its own strengths and weaknesses. Prudent use of available finance—managing cash and cash flow, maintaining desirable balance sheet ratios, and implementing complex tax codes—lie at the heart of CapCo’s expertise. Getting it right is critical to the long-term success of the organization. It is not rocket science, but it requires a level of financial sophistication beyond the reach of many.

The assets acquired by CapCo are made available to RunCo where they are used to complete construction, produce aggregate or asphalt, and generate revenue. RunCo pays CapCo a fixed ownership charge for all the equipment deployed on its projects and is responsible for all operating decisions and costs. RunCo balances its books by charging the jobsites an hourly, daily or weekly use rate for the machines used to generate revenue. A portion of this “rental income” offsets the actual operating costs experienced; a portion offsets the fixed ownership charges.

The disposal of assets at the end of their economic life generates a flow of funds that enables CapCo to extinguish any remaining debt, write off the book value of the machine, and remove the asset from the asset register. If there is a gain on sale relative to book value, then the gain accrues to RunCo as it was through their good efforts that the value of the machine exceeded expectation. If there is a loss on book value. then, by the same token, the difference between book value and residual market value is made up by RunCo.

The details in managing equipment costs

It all seems pretty simple. But, as with most things, the devil is in the details. Let’s consider a few.

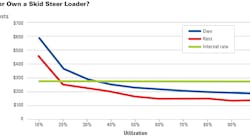

1) RunCo pays a fixed ownership charge for all machines deployed on its projects. It recovers this by charging jobs an hourly, daily or weekly rate for machines used to generate revenue. The risks of not recovering fixed costs therefore lies with RunCo. This is entirely appropriate as RunCo almost certainly championed the purchase decision and RunCo is, or should be, able to manage both the availability and the utilization of the asset.

2) The fact that RunCo benefits when the residual market value received on disposal exceeds book value gives it a stake in the long-term value of the machine and encourages it to look after the asset. This is again entirely appropriate as RunCo is responsible for all operating decisions and can, through good practices and effective training, significantly affect the market value of the equipment it uses.

3) CapCo “owns” the equipment and is responsible for ensuring that it (i) retains value as a corporate asset value and (ii) achieves its assumed economic life. This means that CapCo must be responsible for establishing and enforcing the preventive and condition-based maintenance procedures needed to ensure that machines achieve a full, reliable and productive life cycle. This is not negotiable and an absolutely essential part of any process where one entity owns an asset and another maintains and operates that asset.

4) There is no reason why the fixed ownership charge for a machine should be uniform throughout the life of the machine. Setting it higher than average in the early years makes it possible to recover capital and reduce book value faster. It also reflects the fact that newer, younger machines should have lower operating costs. Setting the ownership charge lower than average in later years provides space in budgets to cover the maintenance and repair costs of older units, and encourages managers to look at the sum of owning and operating costs in their replacement decision. Having the charge continue at a relatively low level after the economic life of the machine has passed creates a strong disincentive to hold onto undeployed or undeployable assets.

5) RunCo focuses on what it does best—produce completed work, aggregate or asphalt on time, on budget and to the required quality. It operates the fleet in a way that maximizes productivity and reliability, and reduces operating costs. It knows the owning cost of the equipment deployed on its projects and maximizes its position relative to CapCo by increasing utilization and focusing on the rate at which it recovers fixed ownership charges.

6) CapCo focuses on what it does best. It seeks out and inks the best deals possible, and optimizes the way in which the company finds and pays for scarce capital resources. It manages a substantial portion of the asset side of the company balance sheet, and marshals the skills and resources needed to do this with unerring success. It maximizes its position relative to RunCo by reducing the after-tax cost of capital and focusing on the astute management of scarce capital.

Many smaller companies do not clearly distinguish between capital asset management (CapCo) and fleet operations management (RunCo), and the equipment manager assumes both responsibilities on a day-to-day basis. This often works well. The problem is that asset-management decisions often come second relative to the day-to-day firefighting associated with running field operations. Finance and investment decisions are made on the fly, which is, frankly, not the way to run a business. Managing the asset side of your balance sheet requires more skill, care and attention.