Managers of construction equipment fleets rated 2019 the highest in several years, but among vocations, those rating numbers varied. All vocations reported positive business years, for the third consecutive year, but water infrastructure and home building were “good” and transportation infrastructure and nonresidential construction were “very good.”

All regions reported either “very good” or “excellent” business years for 2019, lining up with expectations expressed at the end of 2018.

Expectations for 2020 also differ across vocations. Respondents in transportation forecast a slight dip after a “very good” 2019, expecting “good.” Water infrastructure and home building, on the other hand, expect this year to be better than last, with home building expecting a “very good” 2020. Nonresidential remains optimistic, forecasting a “very good” 2020, and fleet managers agree.

2020 Construction Sector Reports

Each of these markets is covered by Scranton Gillette/SGC Horizon publications, siblings of Construction Equipment.

Labor trends seem to support these results. Ken Simonson, chief economist for the Associated General Contractors of America, said in a press release analyzing October labor data:

“The construction industry is still adding workers at a faster clip than the overall economy, but growth has slowed as private nonresidential and multifamily construction spending shrinks. At the same time, public investment and a recent pickup in single-family homebuilding have helped employment to grow.”

New England, Mid-South, and Great Lakes regions reported that 2019 was an “excellent” year, but they join the other six regions in forecasting a “very good” 2020 business year.

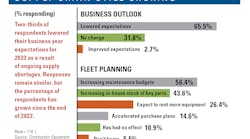

Contract volume expectations continue strong for 2020. Measured as a net between the percentage of respondents expecting an increase in revenue minus the percentage expecting a decrease, forecasts for 2020 are overwhelmingly positive.

Historical Construction Business Reports

Respondents in home building were the most optimistic, with a net of 53 percent. Water infrastructure respondents also net out strongly, at 47 percent. Transportation and nonresidential respondents reported nets a bit lower, but still strongly positive. Fleet managers, who provide the equipment for these vocations, reported a net of 47 percent.

Bid price expectations are even stronger. Again, home builders appear the most optimistic with a net of 76 percent for 2020 forecasts. Water infrastructure and transportation infrastructure net out in the 60-percent range.

Bid price forecasts vary by region. In the Northern Plains, for example, the net is 81 percent, revealing quite confident expectations. Other regions reported nets in the high 60-percent range, extending to 75 percent in Mid-South and Great Lakes regions.

Material prices, a component of bid estimates, are also expected to increase strongly in 2020. Although the year-long trade war showed signs of easing at press time, respondents were certainly considering these costs when looking into 2020. Nonresidential respondents reported a net of 80 percent on material price expectations, and the other three vocations were only slightly lower in the 70-percent range.

Regional expectations show some nets in the low 70-percent range, and Mid Atlantic tops out the nation with a net of 87 percent.

Markets across the industry are either “intensely” or “very” competitive for 67.5 percent of respondents. Among nonresidential respondents, 79.4 percent said markets were “intensely” or “very” competitive; 72.3 percent of transportation, 56.4 percent of home builders, and 39.7 percent of water infrastructure respondents said the same. Nationally, markets were most competitive in the Mid-South, with nearly 80 percent describing them as “intensely competitive” or “very competitive.”

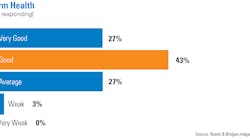

Finally, respondents were asked to describe the overall health of their construction firm. About four of five respondents described it as “very good” or “good,” slightly higher than last year.

Among water infrastructure respondents, that figure was 71 percent; fleet managers represented the other end of the scale, with 84 percent describing firm health as “very good” or “good.”

Annual Report & Forecast Methodology

Construction Equipment partnered with sibling publications in specific construction vocations for a broad view of the construction industry. Our Scranton Gillette/SGC Horizon partners include Building Design+Construction, representing the nonresidential market; Professional Builder, representing the homebuilding industry; Roads & Bridges, on the transportation front; and Water & Wastes Digest, which covers the country’s water infrastructure issues. Each magazine’s editor analyzes their individual market for a more detailed look at the upcoming year.

Construction Equipment has partnered with Case Construction Equipment since 2003 in presenting the Annual Report & Forecast. Case is a full-line manufacturer of earthmoving equipment, and its support of this project allows us to publish substantial amounts of data and analysis for the industry's use.